Week of October 30, 2023 in Review

There was a mix of tricks and treats among last week’s labor sector, home price and Fed rate headlines. Here are the highlights:

- Lower Job Numbers Closer to Real Picture

- Private Payrolls Below Expectations

- “JOLT” Higher for Job Openings

- Continuing Jobless Claims Reach 6-Month High

- Is the Fed Done with Rate Hikes?

- Home Prices Hitting Highs

Lower Job Numbers Closer to Real Picture

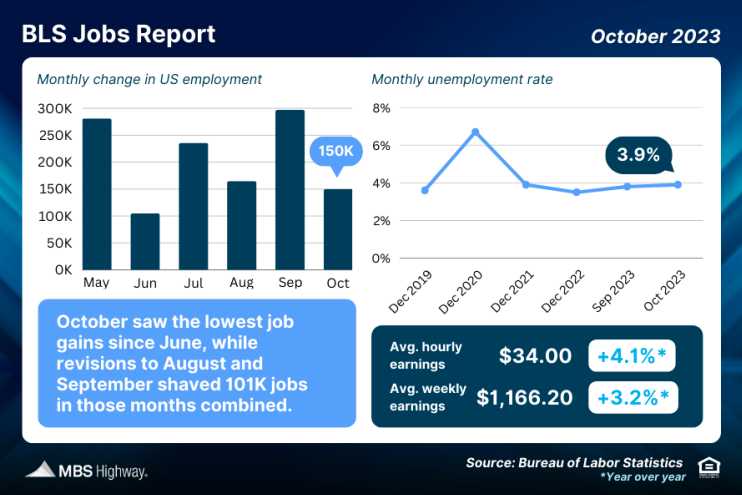

The Bureau of Labor Statistics (BLS) reported that there were 150,000 jobs created in October versus the 180,000 forecasted, which is the lowest amount since June. Revisions to August and September also shaved 101,000 jobs in those months combined. The unemployment rate rose from 3.8% to 3.9%.

What’s the bottom line? There are two reports within the Jobs Report and there is a fundamental difference between them. The Business Survey is where the headline job number comes from, and it’s based predominately on modeling and estimations.

In fact, one of the biggest reasons we saw job gains last month was the birth/death model, where the BLS estimates new business creation relative to closed businesses and how many jobs this created. In October, this modeling added 412,000 jobs but it’s hard to believe that many businesses were started last month in the current economic climate, especially given the cost of capital.

The Household Survey, where the Unemployment Rate comes from, is considered more real-time because it’s derived by calling households to see if they are employed. This survey has its own job creation component and it told a completely different story, showing 348,000 job losses.

Average weekly hours worked also declined slightly, which is important because one of the ways businesses cut costs is to cut the number of hours worked. In fact, workers have lost half an hour on average since the beginning of the year. While this doesn’t sound like much, across 168 million people in the labor force, it equates to 2 million job losses on its own.

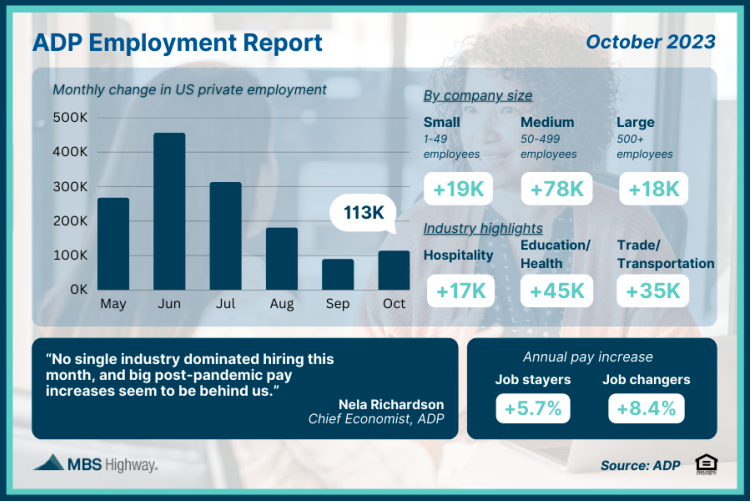

ADP’s Employment Report showed that private payrolls were weaker than forecasted in October with just 113,000 jobs created, while pay growth reached the slowest pace in two years. Almost all the job growth came in service-providing industries, with goods-producing companies only adding 6,000 jobs.

What’s the bottom line? Nela Richardson, chief economist for ADP, noted that “while the labor market has slowed, it’s still enough to support strong consumer spending.” She also explained that “big post-pandemic pay increases seem to be behind us.”

On that note, annual pay for job stayers increased 5.7% and job changers saw an average increase of 8.4%. These figures have cooled considerably from last year’s highs of 8% for job stayers and 16% for job changers, which is significant because it suggests lower wage-pressured inflation.

“JOLT” Higher for Job Openings

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings rose from 9.5 million in August to 9.55 million in September, beating expectations. However, the hiring rate stayed the same at 3.7% which is the lowest since the shutdowns during the pandemic. The quit rate at 2.3% was also unchanged, and this low rate suggests there’s a lack of employers trying to entice workers with other offers.

What’s the bottom line? Despite the monthly increase, job openings are down by 1.3 million when compared to the same time last year. Plus, the reported total for this September is likely overstated. The increase in working from home means job listings are being posted in multiple states more frequently. As a result, they’re being overcounted in the JOLTS total, meaning the report may not be as strong as the headlines suggest.

Continuing Jobless Claims Reach 6-Month High

Initial Jobless Claims rose by 5,000 in the latest week, with 217,000 people filing for unemployment benefits for the first time. The real story is Continuing Claims, which increased by 35,000, showing that 1.82 million people are still receiving benefits after filing their initial claim. The last time Continuing Claims were this high was back in April.

What’s the bottom line? While Initial Jobless Claims remain relatively low, they have increased for the last two weeks, with the latest data reaching highs not seen since early September. Continuing Claims have also risen for seven straight weeks. Overall, the data shows that employers are trying to hold on to workers, but it’s becoming harder for people to find employment once they are let go.

Is the Fed Done with Rate Hikes?

After eleven rate hikes since March of last year, the Fed left their benchmark Federal Funds Rate unchanged at a range of 5.25% to 5.5% at their meeting last Wednesday, just like they did in September. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation.

What’s the bottom line? The Fed’s decision to pause rate hikes for the second straight meeting was unanimous. However, Fed Chair Jerome Powell did leave the door open for another rate hike at their next meeting on December 13. The strength of the labor sector remains a key factor in their decision, with the Fed looking for clear signs that the labor market is softening as they consider further rate hikes.

While the latest job reports for October were weaker than forecasted, it remains to be seen if that’s enough for the Fed to pause additional hikes. The Fed will see November’s job data from ADP and the BLS (releasing December 6 and December 8, respectively), along with upcoming inflation reports, which will certainly play a role in their decision.

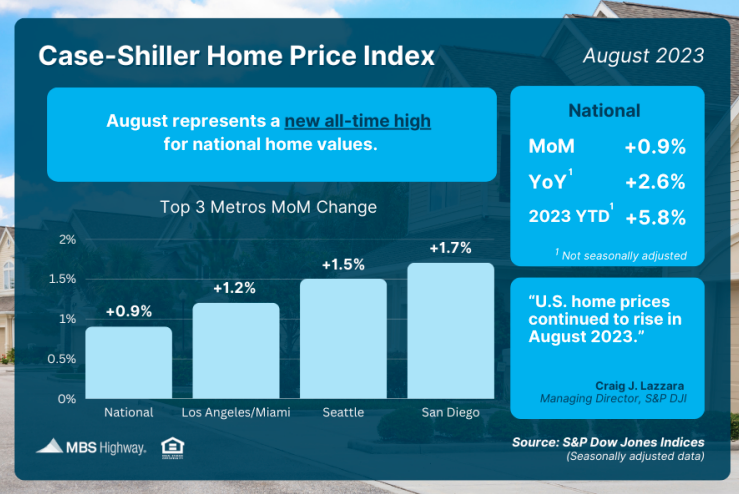

Home Prices Hitting Highs

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.9% from July to August after seasonal adjustment, marking the seventh consecutive month of gains. The Federal Housing Finance Agency’s (FHFA) House Price Index also saw home prices rise 0.6% in August, with their index reporting gains every month so far this year.

Note that FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? Home values have hit new all-time highs according to Case-Shiller, FHFA, CoreLogic, Black Knight and Zillow, more than recovering from the downturn we saw in the second half of 2022. This year, prices are on pace to appreciate between 6-8% depending on the index, based on the reported pace of appreciation through August. These indexes show that now remains a great opportunity for building wealth through homeownership and appreciation gains.

Family Hack of the Week

Fall is the perfect season for roasting root vegetables. This recipe from the New York Times won’t disappoint.

- Preheat oven to 425 degrees Fahrenheit.

- Peel 3 pounds of assorted root vegetables such as carrots, parsnips, turnips, and potatoes and cut them into 1 to 2-inch chunks.

- Place them in a baking pan, toss with 1/4 cup olive oil and a sprinkle of salt and pepper.

- Roast for 20 minutes then turn, drizzling more oil if they look dry.

- Roast for another 20 minutes, then stir in chopped rosemary, thyme, parsley or your herbs of choice.

- Bake for an additional 20 to 30 minutes, until crisp.

- Garnish with rosemary or thyme and enjoy.

What to Look for This Week

The economic calendar is quiet, but we will see more housing appreciation data when CoreLogic’s Home Price Index for September is released on Tuesday. The latest Jobless Claims data will also be reported on Thursday.

Investors will also be closely watching Wednesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.

Technical Picture

Mortgage Bonds tested a dual ceiling on Friday formed by the 101.035 Fibonacci level and 100-day Moving Average. They ended last week in a range between the aforementioned dual ceiling and support at the 100.437 Fibonacci level. The 10-year moved lower last week, testing its 50-day Moving Average on Friday and ending last week trading around 4.57%.