Week of April 15, 2024 in Review

Despite a pullback in sales and construction, the housing sector is showing signs of strength heading into the spring buying season. Plus, Fed Chair Jerome Powell gave some hints about what may be ahead for rate cuts. Read on for these stories and more:

- Existing Home Sales Slip

- Home Builder Sentiment Holds Steady

- Housing Starts Slide in March

- Rates Higher for Longer

- Continuing Unemployment Claims Remain Above 1.8 Million

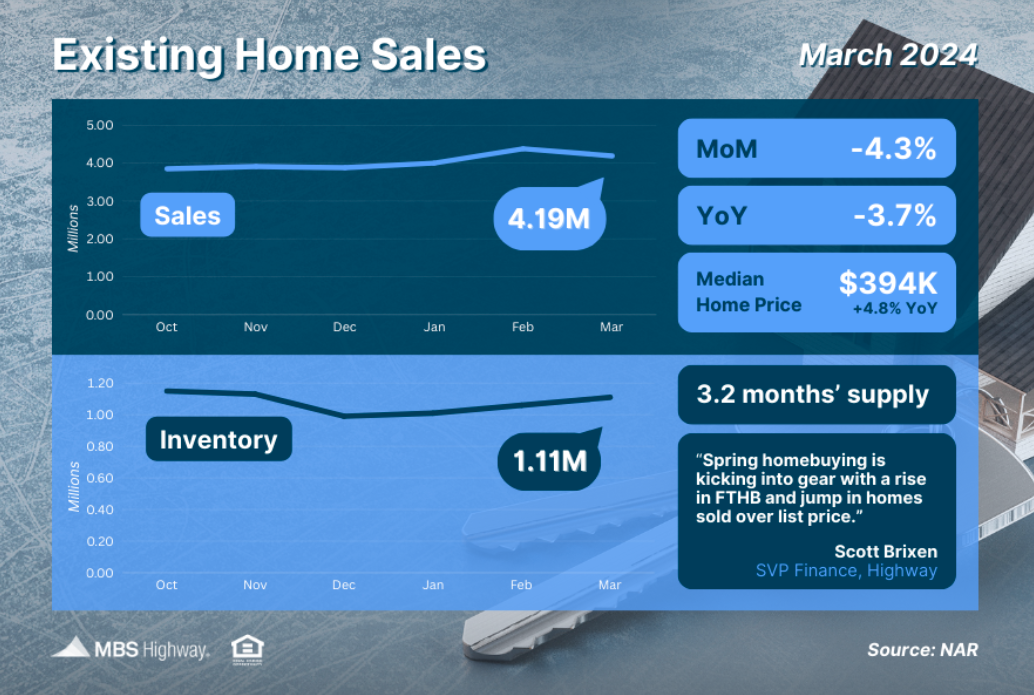

Existing Home Sales Slip

After hitting their highest level in a year in February, Existing Home Sales fell 4.3% in March to a 4.19-million-unit annualized pace, per the National Association of REALTORS (NAR). This report measures closings on existing homes in March and likely reflects people shopping for homes in January and also in February when rates began to tick higher.

What’s the bottom line? While the pace of sales declined in March, it remains at the second highest level since last May, with NAR’s Chief Economist, Lawrence Yun, confirming that sales have rebounded from cyclical lows. In addition, some of the internals within the report showed signs of strength. Homes remained on the market for a shorter period (an average of 33 days in March down from 38 days in February), while a greater number of homes sold above list price (29% in March versus 20% in February). This signals demand and competition remains ahead of the spring buying season.

Plus, there was some good news on the inventory front, as there were 1.11 million homes available for sale at the end of March, up 4.7% from February and 14.4% from a year earlier. While this remains below healthy levels, rising inventory is certainly a step in the right direction to help improve the persistent tight housing supply we’ve seen across the country. Yun added that “more inventory is always welcomed in the current environment.”

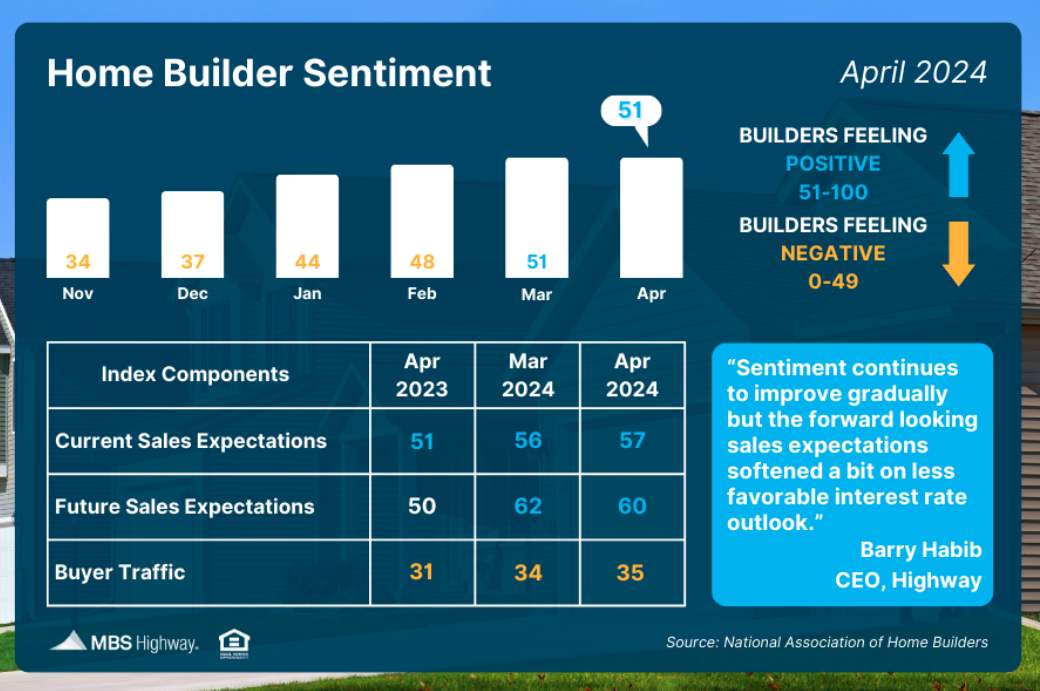

Home Builder Sentiment Holds Steady

Confidence among home builders remained just above the key breakeven threshold of 50 for the second straight month, per the National Association of Home Builders (NAHB), as their Housing Market Index stayed at 51 in April. Any score over 50 on this index, which runs from 0 to 100, signals that more builders view conditions as good than poor.

Among the three index components, current and future sales expectations both remain in expansion territory at 57 and 60, respectively, though future expectations have softened as some buyers remain on the fence. The gauge judging buyer traffic moved higher, but it’s still in contraction territory.

What’s the bottom line? NAHB’s Chief Economist, Robert Dietz, explained, “April’s flat reading suggests potential for demand growth is there, but buyers are hesitating until they can better gauge where interest rates are headed.”

Housing Starts Slide in March

Even though home builder sentiment held steady, builders pulled back on new construction last month, with Housing Starts falling nearly 15% from February. Starts for single-family homes, which make up the bulk of homebuilding and are the most crucial due to buyer demand, were also down 12.4%. There was a similar trend in future construction, with Building Permits moving lower despite much needed supply.

What’s the bottom line? The NAHB noted that higher than expected interest rates, hotter than anticipated inflation, and higher supply side costs all contributed to the construction slowdown last month. Danushka Nanayakkara-Skillington, NAHB’s Assistant VP for Forecasting and Analysis, added that single-family construction will also likely decline in April, given the drop in building permits last month.

Home prices should remain supported, as there still is not enough supply coming on the market to meet demand, showing that opportunities remain to build wealth through homeownership.

Rates Higher for Longer

While speaking to a policy forum on U.S.-Canada economic relations, Fed Chair Jerome Powell said that recent data has “clearly not given us greater confidence” that inflation is moving toward the Fed’s 2% target. This includes hotter than expected consumer inflation readings in recent months, especially as measured by the Consumer Price Index.

Remember, the Fed aggressively hiked their benchmark Fed Funds Rate (the overnight borrowing rate for banks) eleven times between March 2022 and July 2023 to slow the economy and curb runaway inflation. The Fed has held rates steady as of their meeting last September because inflation had been showing good progress lower before stalling in more recent reports.

What’s the bottom line? Powell said it will likely take longer to achieve confidence that inflation is progressing lower, signaling that the timing for rate cuts will probably be delayed and rates will be higher for longer until confidence is restored. This more hawkish tone was echoed by other Fed members last week as well, including New York Fed President John Williams and Atlanta Fed President Raphael Bostic.

Continuing Unemployment Claims Remain Above 1.8 Million

Initial Jobless Claims were flat in the latest week, as another 212,000 people filed for unemployment benefits for the first time. However, Continuing Claims rose by 2,000, with 1.812 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims can be volatile from week to week, but their relatively low level suggests that employers are still trying to hold on to their workers. Yet, Continuing Claims are still trending higher near some of the hottest levels we’ve seen in recent years, as it’s become harder for some people to find new employment once they are let go.

Family Hack of the Week

April 23 is National Picnic Day. Make these Blackberry-Oat Crumble Bars courtesy of Southern Living for a perfectly delicious and portable picnic treat. Yields 24 bars.

- Preheat oven to 350 degrees Fahrenheit.

- Stir together

- 6 cups rolled oats,

- 2 1/4 cups packed light brown sugar,

- 2 1/4 cups all-purpose flour,

- 2 cups melted butter,

- 1 teaspoon kosher salt and

- 1 teaspoon baking soda.

- Remove 3 cups of the oat mixture and set aside.

- Press remaining oat mixture in an even layer on a buttered 12×17-inch rimmed baking sheet.

- Bake until golden brown, approximately 20 minutes.

- Cool completely, for around 30 minutes.

- Meanwhile, stir together

- 9 cups blackberries,

- 1 cup sugar,

- 1/2 cup lemon juice and

- 1/4 cup corn starch in a large saucepan.

- Cook over medium until syrup thickens and bubbles, about 8 minutes.

- Pour over prepared crust and top with reserved crumble.

- Bake at 350 degrees Fahrenheit until the topping is golden brown, around 30 to 35 minutes.

- Cool completely before cutting into bars.

What to Look for This Week

We’ll get an update on signed contracts when March’s New and Pending Home Sales are reported on Tuesday and Thursday, respectively. Thursday also brings the latest Jobless Claims and the first reading on GDP for the first quarter. A crucial inflation reading ends the week on Friday with the Fed’s favored measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds appear to have stabilized in the middle of a wide range with support at 98.867 and resistance at 99.647. The 10-year is also trading in a wide range between support at 4.459% and a ceiling at 4.694%, which is the high for this year.

If you have any questions, please contact me today!