MBS Road Signs 4-29-24

Week of April 22, 2024 in Review

The progress lower on inflation remains stalled, while signed contracts on both new and existing homes rebounded in March. Here are the headlines:

- Inflation Progress Getting Harder

- New Home Sales Data Confuses Media

- Signed Contracts on Existing Homes March Higher

- First Quarter GDP Weaker Than Expected

- Initial Jobless Claims Hit 9-Week Low

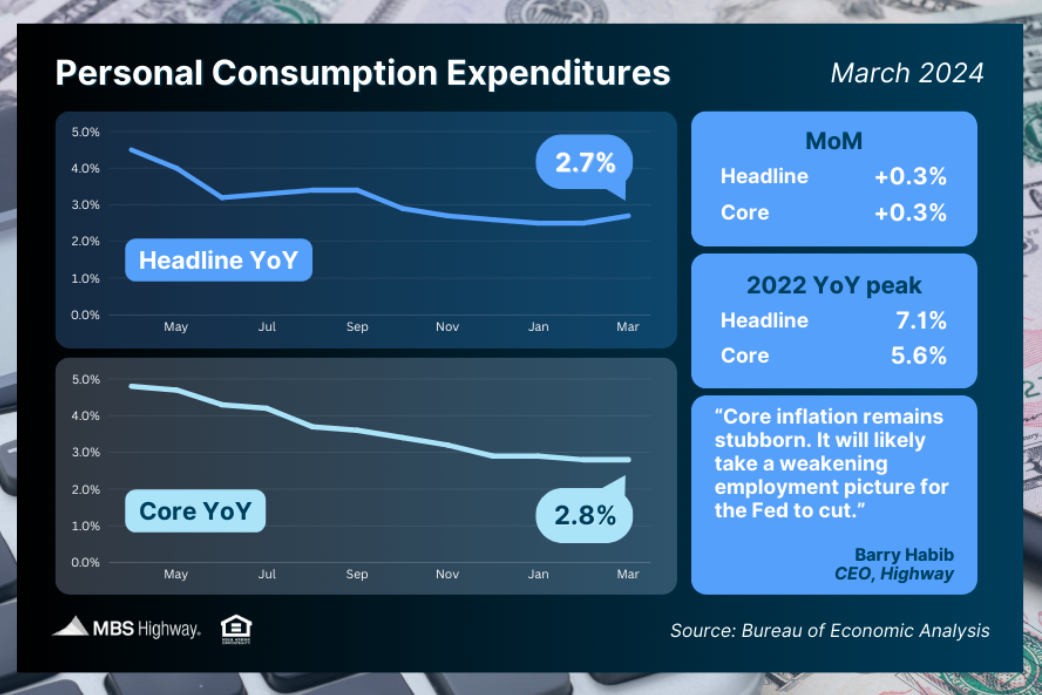

Inflation Progress Getting Harder

March’s Personal Consumption Expenditures (PCE) showed that headline inflation rose 0.3% from February, with the year-over-year reading up from 2.5% to 2.7%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, also rose by 0.3% monthly. The year-over-year reading held steady at 2.8%, stalling progress toward the Fed’s 2% target.

What’s the bottom line? The Fed has been working hard to tame inflation, hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) eleven times between March 2022 and July 2023. These hikes were designed to slow the economy by making borrowing more expensive, lowering the demand for goods, and thereby reducing pricing pressure and inflation.

The Fed has held rates steady since last September because inflation had been showing good progress lower before stalling in more recent reports. At their meeting in March, the Fed still signaled that three rate cuts are ahead this year. Will they change their tune at their meeting this week? We’ll find out on Wednesday with their Monetary Policy Statement and press conference.

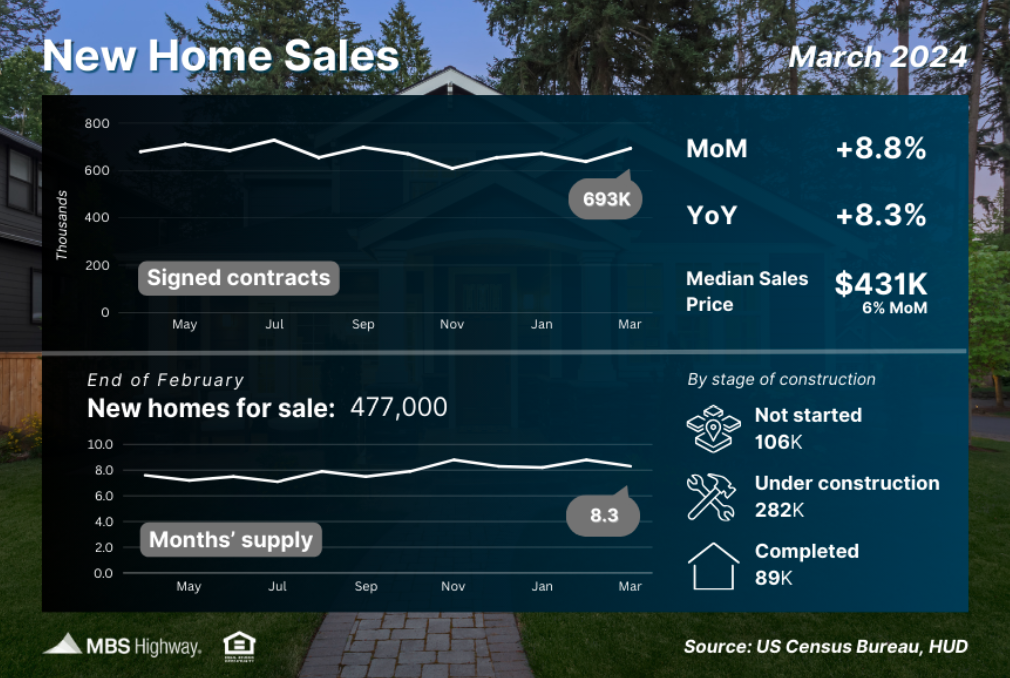

New Home Sales Data Confuses Media

After falling in February, signed contracts on new homes rebounded 8.8% in March to a 693,000-unit annualized pace, reaching their highest level since September. Sales were also 8.3% higher than a year earlier, as the persistent shortage of previously owned

homes for sale continues to fuel demand for new construction.

What’s the bottom line? Despite the strong headline figure, some media pundits pointed to the decline in the median sales price, which was down nearly 2% from a year ago, to say the report was a miss. But the median sales price did not decline because of falling home prices (which continue to rise per Case-Shiller and other indexes), or a growing number of price cuts from builders. In fact, 36% of builders reported cutting prices in December, versus just 24% in March and 22% in April per the National Association of Home Builders.

The median sales price represents the mid-price of sales, meaning it’s influenced by the mix of sales in any given month. March’s decline in the median sales price stems from the sale of more homes at lower price points. Builders are constructing smaller, more affordable homes to meet buyer demand, and that pushed the median sales price lower comparatively.

Signed Contracts on Existing Homes March Higher

Pending Home Sales rose 3.4% from February to March per the National Association of REALTORS (NAR), coming in well above estimates. This report measures signed contracts on existing homes, making it an important forward-looking indicator for closings on these homes, which are measured in the Existing Home Sales report.

What’s the bottom line? The Pending Home Sales index hit its highest level in a year, showing that activity is picking up heading into the spring homebuying season. An increase in inventory and eventual decline in mortgage rates will only boost these sales figures, with NAR’s Chief Economist, Lawrence Yun, noting, “Inventory will grow steadily from more home construction, and various life-changing events will require people to trade up, trade down or move to another location.”

First Quarter GDP Weaker Than Expected

The first reading of first quarter 2024 Gross Domestic Product (GDP) showed that the U.S. economy grew by 1.6%. This was well below both the 2.5% estimate and the 3.4% growth seen in the fourth quarter of last year.

What’s the bottom line? Slower economic growth is typically good news for the bond market, but the hotter than expected inflation component within the report led to a selloff when the data was reported last Thursday. Note that this data is subject to revision when the second and final readings are released on May 30 and June 27, respectively.

However, the weaker than expected initial reading is disappointing given that GDP functions as a scorecard for the country’s economic health.

Initial Jobless Claims Hit 9-Week Low

Initial Jobless Claims fell by 5,000 in the latest week, as another 207,000 people filed for unemployment benefits for the first time. Continuing Claims also declined by 15,000, with 1.781 million people still receiving benefits after filing their initial claim.

What’s the bottom line? The low level of Initial Jobless Claims suggests that employers are still trying to hold on to their workers. Yet, Continuing Claims are still trending near some of the hottest levels we’ve seen in recent years, as challenges remain for job seekers searching for their next position

Family Hack of the Week

May 2 is National Truffles Day! Celebrate with these delicious and decadent Chocolate Truffles courtesy of New York Times Cooking. Yields 24 truffles.

- Heat 7/8 cup of heavy cream in a pot until it steams.

- Add 8 ounces of chopped bittersweet chocolate to a bowl, pour hot cream on top, and stir until chocolate is melted and incorporated into the cream.

- Chill until solid all the way through, around 1 to 2 hours.

- Using a chilled melon baller, scoop out a tablespoonful and quickly roll into a ball.

- Repeat with remaining chocolate, lining truffles on a plate or baking sheet.

- If truffles become too soft to handle, place them in refrigerator or freezer for a few minutes.

- Roll truffles in cocoa powder, confectioners’ sugar, or a mixture of sugar and cinnamon.

- Enjoy immediately or store in refrigerator for up to four days.

What to Look for This Week

Housing and labor sector data will share headlines with the Fed, starting Tuesday with appreciation data for February from Case-Shiller and the Federal Housing Finance Agency. We’ll also see updates on job openings and private payrolls (Wednesday), unemployment claims (Thursday), and nonfarm payrolls and the unemployment rate (Friday).

The Fed’s meeting begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday. Investors will be closely listening for news regarding the timing of rate cuts later this year.

Technical Picture

Mortgage Bonds continue to trade in a wide range between support at 98.867 and overhead resistance at 99.647. The 10-year retreated from the yearly high it reached last Thursday, and there is room for yields to improve and move lower if we receive some Bond-friendly news this week.

If you have any questions, please contact me!