Week of August 7, 2023 in Review

Crucial inflation data sparked volatility in the markets, while another home price index report shows the opportunity that exists in homeownership. Read on for these stories and more:

- Is Consumer Inflation Rearing Its Head Again?

- Wholesale Inflation Hotter Than Expected

- Home Price Appreciation Heading Higher

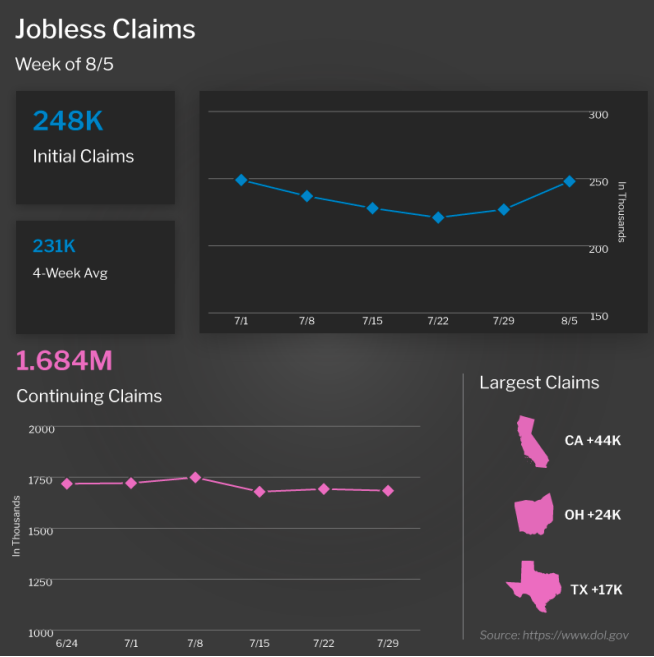

- Is the Rise in Initial Jobless Claims a New Trend?

Is Consumer Inflation Rearing Its Head Again?

July’s Consumer Price Index (CPI) showed that inflation rose 0.2%, with this monthly reading coming in just below estimates. On an annual basis, however, CPI increased from 3% to 3.2% last month, though this is still near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased 0.2% while the annual reading declined from 4.8% to 4.7%.

Declining costs for used cars and airfares helped inflation last month, as did moderate readings for shelter, gasoline and food.

What’s the bottom line? While annual inflation did move in the wrong direction, this notch higher is partly due to a slightly negative figure from last July, which was removed from the rolling 12-month calculation and replaced with last month’s 0.2% reading. Inflation has made significant progress lower after peaking at 9.1% in June 2022. Easing inflation is welcome news as it signifies a break from price increases for some goods and services. Plus, lower inflation also typically helps both Mortgage Bonds and mortgage rates improve over time.

Wholesale Inflation Hotter Than Expected

The Producer Price Index (PPI), which measures inflation on the wholesale level, increased by 0.3% in July, coming in just above expectations. On an annual basis, PPI rose from 0.2% to 0.8%. Core PPI, which also strips out volatile food and energy prices, rose by 0.3%, with the year-over-year reading remaining at 2.4%.

What’s the bottom line? While annual PPI also moved higher in the wrong direction, it was coming from a very low level and remains extremely muted, well below last year’s 11.7% peak.

There has been mixed chatter from the Fed regarding whether they will hike rates again at their meeting on September 20. Remember, the Fed started hiking their benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) last year to slow the economy and help curb runaway inflation. The Fed will be closely watching upcoming CPI and PPI readings for August (releasing September 13 and 14) and their favored inflation report Personal Consumption Expenditures (July’s data releases August 31) as they weigh this decision.

Home Price Appreciation Heading Higher

Black Knight’s Home Price Index hit an all-time high in June, with “nearly every major market experiencing month-over-month growth.” Home prices rose 0.7% in June and they are now up 0.8% on an annual basis, with appreciation at 2.9% through the first six months of this year. At this pace, prices are on track to appreciate 5.8% in 2023.

What’s the bottom line? The latest rise in home prices reported by Black Knight mirrors the strong growth that’s also been noted by Case-Shiller, CoreLogic, Zillow and the Federal Housing Finance Agency in their respective indexes. These gains are a far cry from the housing crash that many media pundits had forecasted and show that opportunities exist right now to build wealth through homeownership and appreciation.

Is the Rise in Initial Jobless Claims a New Trend?

After staying below 230,000 for three straight weeks, Initial Jobless Claims rose by 21,000, as 248,000 people filed for unemployment benefits for the first time. Continuing Claims fell by 8,000, with 1.684 million people still receiving benefits after filing their initial claim. This latter metric has been on a downward trend from the high of 1.861 million reported in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? Initial Jobless Claims have remained relatively low of late due to the difficulty hiring that many businesses are reporting. After all, businesses that can’t find qualified workers certainly aren’t going to lay off the ones they have. For example, the National Federation of Independent Business noted that 92% of small businesses looking to hire last month could not find qualified workers for their positions. We’ll have to see if this latest Initial Jobless Claims report is a one-off jump or the start of a new trend higher reflecting some of the weakness we are seeing in the labor market.

Family Hack of the Week

It’s National Peach Month. This easy Peach Cobbler from the Food Network is a classic summer dessert your friends and family will love.

Preheat oven to 325 degrees Fahrenheit. Add 4 cups sliced and peeled peaches to a 9×9-inch baking pan. In a medium bowl, mix 1 cup all-purpose flour, 3/4 cup granulated sugar, 1 teaspoon baking powder and 1/2 teaspoon Kosher salt. Add 1/2 cup milk and 4 tablespoons melted unsalted butter; mix well. Pour batter evenly over peaches.

In a small bowl, mix 1/4 cup sugar, 1 tablespoon cornstarch and 1/2 teaspoon salt. Sprinkle over the batter. Evenly pour 1/2 cup boiling water over cobbler. Bake until golden brown and bubbling, approximately 50 minutes. Enjoy topped with your favorite whipped cream or vanilla ice cream.

What to Look for This Week

Important housing reports are ahead, starting Tuesday with an update on home builder sentiment for this month from the National Association of Home Builders. July’s Housing Starts and Building Permits follow on Wednesday.

Look for August’s manufacturing data for the New York and Philadelphia regions on Tuesday and Thursday, respectively. July’s Retail Sales will also be released on Tuesday and the latest Jobless Claims on Thursday. Plus, the minutes from the Fed’s July meeting will be released on Wednesday and these always have the potential to add volatility to the markets.

Technical Picture

Mortgage Bonds ended last week trading in the middle of a very wide range between support at 97.984 and overhead resistance at 98.716. Bond prices are susceptible to whipsaws when in such a wide range like this. The 10-year ended last week above support at 4.09%. The next ceiling is at 4.23% if yields continue to worsen.