Week of September 11, 2023 in Review

Key inflation data was reported ahead of this week’s Fed meeting, while home prices continue to show signs of strength. Here are the latest stories:

- What “Fueled” the Rise in Consumer Inflation?

- Is the Rise in Wholesale Inflation a Concern?

- New High in Home Price Appreciation

- Important Context Regarding Tame Jobless Claims

What “Fueled” the Rise in Consumer Inflation?

August’s Consumer Price Index (CPI) showed that inflation rose 0.6%, with this monthly reading coming in right around estimates. On an annual basis, CPI increased from 3.2% to 3.7% last month, though this is still near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased 0.3% while the annual reading declined from 4.7% to 4.3%.

Surging energy and gasoline prices accounted for much of the monthly increase, while tame food and shelter prices and declining costs for used cars helped inflation last month. Note that if the United Auto Workers strike ends up having a prolonged impact on the supply of new cars, we could see used car prices start to rise again.

What’s the bottom line? While annual PPI also moved higher in the wrong direction, it was coming from a very low level and remains extremely muted, well below last year’s 11.7% peak. Plus, much of the increase in wholesale inflation was also due to rising energy prices, like we saw with consumer inflation.

Plus, New York Fed President John Williams recently acknowledged that inflation would be even lower if decelerating shelter costs were better reflected in the reporting, with less of a lag effect.

Is the Rise in Wholesale Inflation a Concern?

The Producer Price Index (PPI), which measures inflation on the wholesale level, increased by 0.7% in August, coming in hotter than expected. On an annual basis, PPI doubled from 0.8% to 1.6%. Core PPI, which also strips out volatile food and energy prices, rose by 0.2%, with the year-over-year reading dropping from 2.4% to 2.2%.

What’s the bottom line? While annual PPI also moved higher in the wrong direction, it was coming from a very low level and remains extremely muted, well below last year’s 11.7% peak. Plus, much of the increase in wholesale inflation was also due to rising energy prices, like we saw with consumer inflation.

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years Will the progress we’ve seen so far on inflation be enough for the Fed to pause further hikes? Recent comments from several Fed members suggest that’s the case, including New York President John Williams (monetary policy is in “a good place”), Dallas Fed President Lorie Logan (skipping a hike this month “could be appropriate”), and Philadelphia Fed President Patrick Harker (the Fed may be at a point to “hold rates steady”).

We’ll find out what the Fed decides for sure this Wednesday, after their two-day meeting concludes.

New High in Home Price Appreciation

CoreLogic’s Home Price Index showed that home prices nationwide rose for the six straight month, up 0.4% from June to July. Prices were also 2.5% higher when compared to July of last year. CoreLogic forecasts that home prices will rise 0.4% in August and 3.5% in the year going forward, though their forecasts tend to be on the conservative side historically. In fact, CoreLogic’s index is on pace for just under 9% appreciation in 2023, based on the monthly gains we’ve seen so far this year.

Zillow also reported that home values have increased 4.5% since the beginning of this year, with their index showing new all-time highs in home values month after month since May. Zillow’s index is on pace for 7% appreciation this year, based on the monthly gains we’ve seen to date.

What’s the bottom line? The latest rise in home prices reported by CoreLogic and Zillow echoes the strong growth seen by Case-Shiller, Black Knight and the Federal Housing Finance Agency. These reports continue to demonstrate why homeownership remains a good investment and opportunity for building wealth through real estate.

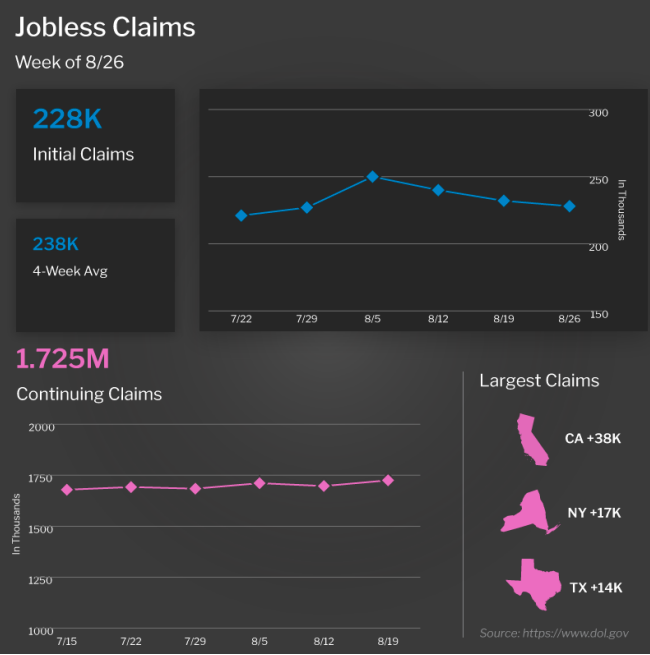

Important Context Regarding Tame Jobless Claims

Initial Jobless Claims rose by 3,000 in the latest week, with 220,000 people filing for unemployment benefits for the first time. Continuing Claims also increased by 4,000, with 1.688 million people still receiving benefits after filing their initial claim. This latter number has been trending lower since topping 1.861 million in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? While the tame level of Initial Jobless Claims suggests a strong labor market, the measured week included the Labor Day holiday, so the shortened filing time may have impacted the data.

Plus, Initial Jobless Claims are usually the last data point to reflect a slowdown in the job market. Typically, we first see a slowdown in job postings, hirings, and a reduction in hours before layoffs occur. These first three trends have been seen in recent reports. It will be important to see if a sustained rise in Initial Jobless Claims follows in the coming months, especially with the Fed looking for clear signs that the labor market is softening as they consider further rate hikes this fall.

Family Hack of the Week

This Thursday, September 21 is National Pecan Cookie Day, which is the perfect excuse for making this delicious Butter Pecan Cookie recipe courtesy of Taste of Home.

Preheat oven to 325 degrees Fahrenheit. Add 1 3/4 cups chopped pecans and 1 tablespoon butter to a baking pan. Bake for 5 to 7 minutes until pecans are toasted and browned, stirring frequently. Set aside to cool.

In a large bowl, cream 1 cup packed brown sugar and 1 cup softened butter until light and fluffy, approximately 5 to 7 minutes. Beat in 1 egg yolk and 1 teaspoon pure vanilla extract. Add 2 cups self-rising flour and mix well. Cover and refrigerate for 1 hour.

Preheat oven to 375 degrees Fahrenheit. Roll dough into 1-inch balls, then roll balls in the toasted pecans. Place 2 inches apart on ungreased baking sheets. Top each cookie with a pecan half. Bake for 10 to 12 minutes until golden brown.

What to Look for This Week

Important housing reports are ahead, starting Monday with an update on home builder sentiment for this month from the National Association of Home Builders. August’s Housing Starts and Building Permits will be reported on Tuesday, while Existing Home Sales follow on Thursday.

Also on Thursday, look for the latest Jobless Claims and September’s manufacturing data for the Philadelphia region. But the Fed will likely steal the show as their two-day meeting begins Tuesday, with their Monetary Policy Statement, rate decision and press conference coming on Wednesday.

Technical Picture

Mortgage Bonds broke beneath support at their 25-day Moving Average, ending last week testing the next floor at 98.086. The 10-year broke above the ceiling of resistance at 4.29%, with the next ceiling at 4.36%.

If you have any questions, please contact me today!