Week of October 2, 2023 in Review

September brought a blowout job creation number from the Bureau of Labor Statistics, but is the labor sector as strong as that data suggests? Meanwhile, appreciation reports

show that home prices are reaching new record highs. Here are last week’s headlines:

- Soaring September Job Growth Defies Expectations

- Private Payrolls at Weakest Pace in Almost Three Years

- Job Openings a Surprise “JOLT” Higher

- Tame Unemployment Claims a Contrast to Job Cuts

- More Record Highs for Home Prices

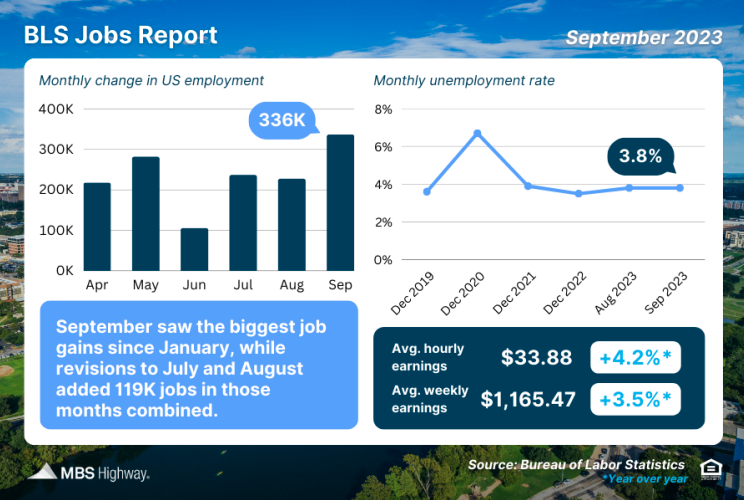

Soaring September Job Growth Defies Expectations

The Bureau of Labor Statistics (BLS) reported that there were 336,000 jobs created in September, nearly double the forecasted amount and the highest since January. Revisions to July and August also added 119,000 jobs (all government) in those months combined. The unemployment rate held steady at 3.8%, just above the expected decline to 3.7%.

What’s the bottom line? There are two reports within the Jobs Report and there is a fundamental difference between them. The Business Survey is where the headline job number comes from, and it’s based predominantly on modeling and estimations. The Household Survey, where the Unemployment Rate comes from, is considered more real-time because it’s derived by calling households to see if they are employed.

The Household Survey has its own job creation component, and it told a completely different story, only showing 86,000 job creations. September’s report also showed sizeable increases in multiple job holders (+123,000) and part-time workers (+151,000), while full-time workers fell by 22,0000, suggesting some softening in the job market and economy overall.

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. They have been looking for clear signs that the labor market is softening as they consider further rate hikes. Despite some underlying weakness in the data, the strong headline job number raises the risk of another rate hike at the Fed’s next meeting on November 1.

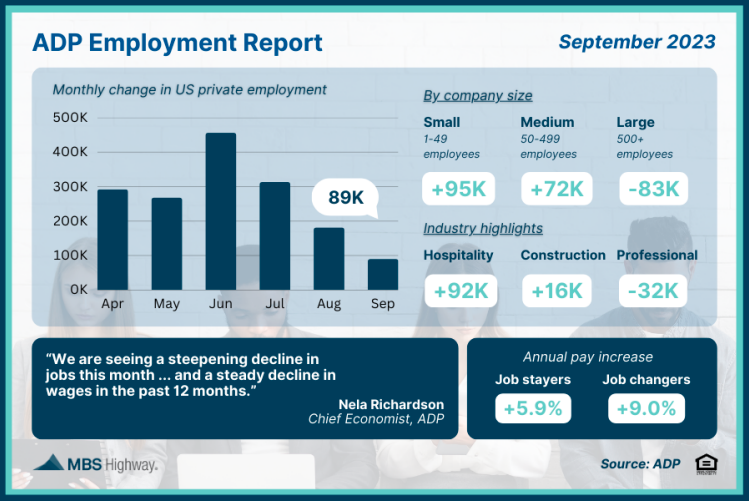

Private Payrolls at Weakest Pace in Almost Three Years

ADP’s Employment Report showed that private payrolls were weaker than forecasted in September with just 89,000 jobs created, marking the slowest pace of growth since January 2021. While job gains were reported among small and mid-sized businesses, large businesses with 500+ employees shed 83,000 jobs. Among the various sectors, leisure and hospitality was by far the strongest, adding 92,000 jobs, though these gains were offset by losses seen in manufacturing, trade/transportation/utilities, and professional/business services.

What’s the bottom line? “We are seeing a steepening decline in jobs this month,” said Nela Richardson, chief economist for ADP. “Additionally, we are seeing a steady decline in wages in the past 12 months.” On that note, annual pay for job stayers increased 5.9% and job changers saw an average increase of 9.0%. These figures have cooled considerably from last year’s highs of 8% for job stayers and 16% for job changers, which is significant because it suggests lower wage-pressured inflation.

Job Openings a Surprise “JOLT” Higher

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings rose from 8.92 million in July to 9.61 million in August. This was an unexpected move higher, as job openings had been declining every month since April. Professional and business service positions accounted for a large share of openings.

What’s the bottom line? Despite the monthly increase, job openings are down almost 6% when compared to the same time last year. Plus, the reported total for this August is likely overstated. The increase in working from home means job listings are being posted in multiple states more frequently. As a result, they’re being overcounted in the JOLTS total.

The Fed also follows this report closely for signs of labor sector weakness. Will they look deeper than the headline figure as they consider further rate hikes? Tame Unemployment Claims a Contrast to Job Cuts Initial Jobless Claims rose by 2,000 to 207,000 in the latest week, with the number of people filing for unemployment benefits for the first time continuing to hover near eightmonth lows. The low level of first-time filings suggests that employers are holding on to workers.

Continuing Claims fell by 1,000, reaching the lowest level since January, with 1.664 million people still receiving benefits after filing their initial claim. This data has been trending lower since topping 1.861 million in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? The low level of unemployment claims paints a much different picture than the latest Job Cuts report from Challenger, Gray & Christmas, which showed that job cuts year-to-date are the highest January to September total since 2009 (except for COVID in 2020). Again, we’ll find out how the Fed responds to the mixed labor sector data at their meeting on November 1.

More Record Highs for Home Prices

CoreLogic’s Home Price Index showed that home prices nationwide rose 0.3% from July to August, hitting a new all-time high for the fourth straight month. CoreLogic forecasts that home prices will rise 0.2% in September and 3.4% in the year going forward, though their forecasts tend to be on the conservative side historically. In fact, CoreLogic’s index is on pace for just over 8% appreciation in 2023, based on the monthly readings we’ve seen so far this year.

Black Knight also reported that national home values rose 0.7% in August, with their index also showing new all-time highs in home values for the fourth month in a row. Home prices are now 2.5% above the 2022 peak in Black Knight’s index, which is also on pace for 8% appreciation this year based on the monthly gains we’ve seen to date.

What’s the bottom line? The latest rise in home prices reported by CoreLogic and Black Knight echo the strong growth seen by Case-Shiller, Zillow and the Federal Housing Finance Agency. These reports continue to demonstrate why homeownership remains a good opportunity for building wealth through real estate.

Family Hack of the Week

This Vegetable Soup courtesy of the Food Network is easy, delicious and perfect to enjoy all autumn long.

Heat 2 tablespoons olive oil in a heavy pot. Add 1 cup each chopped onion and chopped celery and cook until tender. Stir in 1 cup chopped carrots and 1 cup peeled and diced Idaho potato and toss to coat. Stir in 1 cup chopped zucchini, 1 cup diced can tomatoes, and 6 cups vegetable stock.

Reduce heat and simmer until potatoes and carrots are tender, about 15 to 20 minutes. Stir in 1/2 cup tiny pasta and 1 cup frozen peas. Simmer for an additional five minutes. Enjoy with your favorite crusty bread.

What to Look for This Week

Crucial inflation reports are ahead, starting with September’s Producer Price Index on Wednesday, which will give us news on wholesale inflation. Look for the Consumer Price Index on Thursday.

Also of note, Tuesday brings the NFIB’s report on confidence among small business owners for last month while the latest Jobless Claims will be reported on Thursday. Investors will also be closely watching Wednesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.

Plus, the minutes from the Fed’s latest meeting will be released on Wednesday and these always have the potential to move the markets.

Technical Picture

Mortgage Bonds ended last week sitting on support at 97.67. If this level holds, there is room for improvement before reaching the next ceiling at 98.072. The 10-year ended last week around 4.80% after rising as high as 4.875%.

If you have any questions, please contact me today!