Week of January 8, 2024 in Review

Inflation continues to make progress lower while home prices nationwide are on the rise. Here are last week’s headlines:

- Annual “Core” Consumer Inflation Falls Below 4%

- Wholesale Inflation Lower Than Expected

- Home Prices Continue to Move Higher

- Holiday Season Impact on Jobless Claims

Annual “Core” Consumer Inflation Falls Below 4%

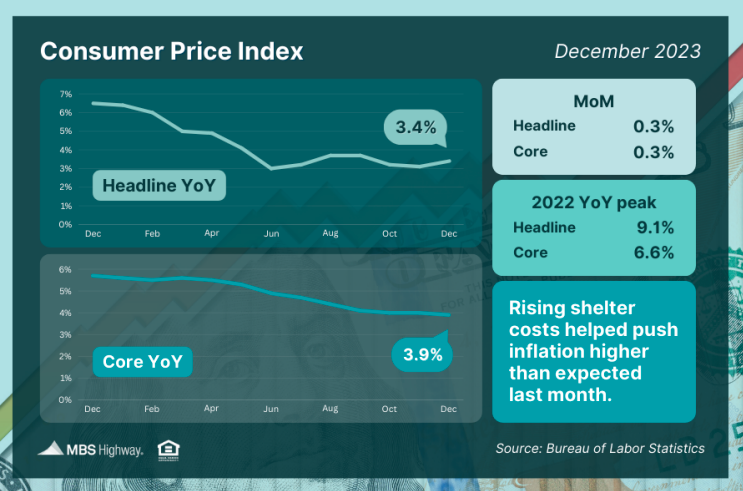

Inflation rose 0.3% from November to December, per the Consumer Price Index (CPI). CPI also rose from 3.1% to 3.4% on an annual basis, though this is still near the lowest level in almost three years. Core CPI, which strips out volatile food and energy prices, increased 0.3% while the annual reading fell from 4% to 3.9%. This was the first time Core CPI fell below 4% in over two years!

Rising costs for energy, used cars and motor vehicle insurance all contributed to the increase in inflation last month. High shelter costs were also a factor, though these have been moderating based on other reports, which should help inflation move even lower once the reporting catches up.

What’s the bottom line? Inflation has made significant progress lower after peaking in 2022, with the headline reading now at 3.4% (down from 9.1%) and the core reading at 3.9% (down from 6.6%). Remember, the Fed began aggressively hiking the Fed Funds Rate (the overnight borrowing rate for banks) in March 2022 to try to slow the economy and curb runaway inflation. Following eleven hikes in this cycle, the Fed pressed pause at their last three meetings in 2023, as signs of cooling inflation grew. Will the progress we’ve seen on inflation be enough for the Fed to shift from rate hikes to rate cuts later this year, as many economists expect?

Wholesale Inflation Lower Than Expected

The Producer Price Index (PPI), which measures inflation on the wholesale level, fell 0.1% in December, coming in below the expected 0.1% rise. On an annual basis, PPI rose from an anemic 0.8% to 1%, also lower than expected. Core PPI, which strips out volatile food and energy prices, was flat for the month with the year-over-year reading down from 2% to 1.8%.

What’s the bottom line? This latest PPI report is another encouraging sign that inflation is easing, with December’s 1% year-over-year reading a sharp drop from 2022’s 11.7% peak. Plus, lower producer inflation often leads to lower consumer inflation if these savings are passed on to consumers.

Home Prices Continue to Move Higher

“Home price appreciation continued to push forward in November, despite the new highs in mortgage rates seen over the year,” per CoreLogic’s Chief Economist, Dr. Selma Hepp. Their Home Price Index showed that home prices nationwide rose 0.2% from October to November, hitting a new all-time high for the seventh straight month. Prices were also 5.2% higher than in November 2022.

CoreLogic forecasts that home prices will fall 0.2% in December and rise 2.5% in the year going forward, though their forecasts tend to be on the conservative side historically. In fact, CoreLogic’s index is on pace for 7% appreciation in 2023, based on the readings for the first eleven months of last year.

What’s the bottom line? The latest rise in home prices reported by CoreLogic echoes the strong growth seen by other major indices like Case-Shiller and the Federal Housing Finance Agency. These reports continue to demonstrate why homeownership remains a good opportunity for building wealth through real estate.

Holiday Season Impact on Jobless Claims

Initial Jobless Claims declined by 1,000 in the latest week, as 202,000 people filed for unemployment benefits for the first time. Continuing Claims also fell by 34,000, with 1.834 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims are historically lower during the holiday season, as layoffs tend to wane before Christmas and New Year’s. And while Continuing Claims have moved lower over the last few weeks, they are still elevated and suggest it’s becoming harder for people to find employment once they are let go.

Family Hack of the Week

Sunday, January 21 marks National Granola Bar Day. This homemade version from the Food Network makes for an easy and delicious afternoon snack or breakfast on the go. Yields 48 bars.

- Preheat oven to 325 degrees Fahrenheit.

- Line a 15×10-inch rimmed baking sheet with foil and coat with cooking spray.

- In a large bowl, mix

- 2 1/2 cups rolled or quick-cooking oats,

- 1 cup dry roasted peanuts,

- 1/2 cup raisins,

- 1/2 cup cranberries,

- 1 cup sunflower seeds,

- 1 1/2 teaspoons cinnamon,

- 1 14-ounce can sweetened condensed milk, and

- 1 stick melted unsalted butter.

- Spread evenly on the baking sheet and bake until golden, approximately 45 minutes.

- Cool slightly, then use the foil to lift off baking sheet and invert onto a cutting board.

- Peel off foil, cut into bars, and wrap individually in plastic wrap.

What to Look for This Week

After the market closures Monday in honor of the Martin Luther King Jr. holiday, housing data highlights this week’s calendar. Wednesday brings builder confidence for this month from the National Association of Home Builders. December’s Housing Starts and Building Permits follow on Thursday, while Existing Home Sales will be delivered on Friday.

Also of note, look for December’s Retail Sales on Wednesday and the latest Jobless Claims on Thursday.

Technical Picture

Mortgage Bonds ended last week above support at the 101.392 Fibonacci level. They have a lot of room for improvement before reaching the next ceiling at 101.952. The 10-year has started to retreat from the formidable ceiling of resistance formed by the 200-day and 25-day Moving Averages and the 4.056% Fibonacci level. Yields have a clear path down to 3.76% before reaching the next floor of support.