Week of March 11, 2024 in Review

Both consumer and wholesale inflation were hotter than expected last month. Plus, retail sales in February rebounded from January’s sharp decline, but not as much as economists had forecasted. Here are the headlines:

- Upside Surprise to Consumer Inflation

- Wholesale Inflation Comes in Hot

- February Retail Sales Below Estimates

- New Seasonal Adjustments Impact Jobless Claims

Upside Surprise to Consumer Inflation

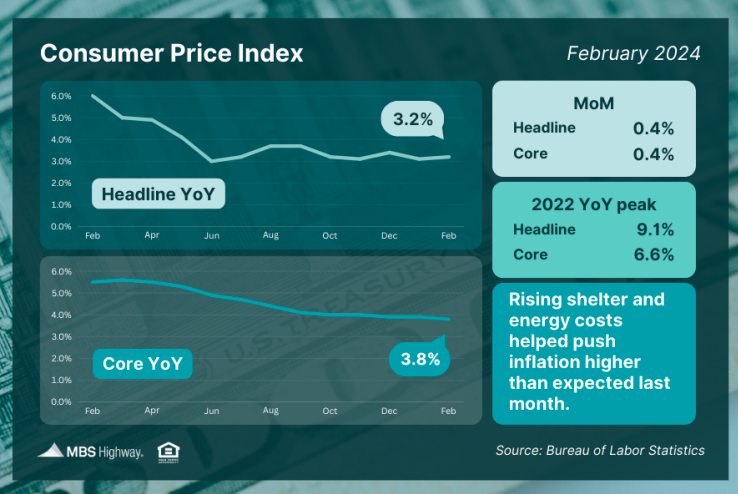

The latest Consumer Price Index (CPI) showed that inflation rose 0.4% from January to February, coming in right around forecasts. CPI also rose from 3.1% to 3.2% year over year, which was above the expected unchanged reading. Core CPI, which strips out volatile food and energy prices, increased 0.4% while the annual reading fell from 3.9% to 3.8%. Both figures were slightly higher than estimates.

Rising shelter and energy costs were two key factors that helped push inflation higher last month. What’s the bottom line? Inflation has fallen considerably after peaking in 2022, with the headline reading now at 3.2% (down from 9.1%) and the core reading at 3.8% (down from 6.6%). However, CPI was hotter than expected for both January and February, meaning inflationary pressures have been more persistent than the Fed would like.

Wholesale Inflation Comes in Hot

The Producer Price Index (PPI), which measures inflation on the wholesale level, rose 0.6% in February, doubling market estimates. On an annual basis, PPI rose from 1% to 1.6%, well above the 1.1% that was forecasted. Core PPI, which strips out volatile food and energy prices, was hotter than expected with a 0.3% rise. The year-over-year reading remained at 2%, just above forecasts.

What’s the bottom line? Despite the upside surprise in the data, wholesale inflation is still well below 2022’s peak. February’s 1.6% year-over-year reading is a sharp drop from the 11.7% high that was reached a few years ago.

Remember, the Fed began aggressively hiking the Fed Funds Rate (the overnight borrowing rate for banks) in March 2022. These hikes were designed to slow the economy by making borrowing more expensive, lowering the demand for goods, and thereby reducing pricing pressure and inflation. After eleven hikes in this cycle, the Fed pressed pause at their last four meetings as signs of cooling inflation grew.

While the Fed is still expected to start cutting the Fed Funds Rate this year, these hotter than expected inflation readings could push back the timing of their plans. We will likely receive more guidance on Wednesday once this week’s Fed meeting concludes, and they release their latest Statement of Economic Projections. The last update in December showed that Fed members projected a median of three rate cuts for this year. It will be important to see whether recent inflation and employment data impact these forecasts.

February Retail Sales Below Estimates

Retail Sales rose 0.6% from January to February though this modest rebound was below estimates of an 0.8% gain. Sales in January were also revised downward from the originally reported 0.8% decline to a 1.1% decline when compared to December.

What’s the bottom line? After a strong holiday shopping season, consumer spending has cooled in the first quarter of this year. While January’s harsh weather certainly impacted sales at the start of the year, the growing use of credit cards and buy now pay later programs could also be contributing to slower spending as consumers pay back holiday season and other debts.

The Fed will be closely watching future Retail Sales reports, as the strength of our economy will also impact their monetary policy decisions this year.

New Seasonal Adjustments Impact Jobless Claims

There were 209,000 Initial Jobless Claims filed in the latest week, marking a decline of 1,000 applications for new unemployment benefits from the previous week. Continuing Claims rose by 17,000, with 1.811 million people still receiving benefits after filing their initial claim.

What’s the bottom line? The latest Continuing Claims figure is much lower than the 1.9 million readings we’ve been seeing, but the decline is not due to improving conditions in hiring. The Bureau of Labor Statistics changed their seasonal adjustments, which has caused big revisions throughout the prior weeks’ reporting. Yet even with these adjustments, Continuing Claims are still trending higher compared to a year ago, showing that it’s become harder for some people to find new employment once they are let go.

On a related note, the latest small business optimism survey from the National Federation of Independent Business showed that small businesses are struggling on the labor front, with plans to hire and plans to increase compensation both hitting three-year lows.

Family Hack of the Week

March Madness means munchies! This Courtside Caramel Corn courtesy of Taste of Home will be a slam dunk with friends and family. Pop 6 quarts of popcorn and set aside. Preheat oven to 250 degrees Fahrenheit. Grease 2 13×9-inch baking pans. In a large saucepan, combine 2 cups packed brown sugar, 1 cup butter (cubed), 1/2 cup corn syrup and 1 teaspoon salt. Bring to a boil over medium heat and boil for 5 minutes, stirring occasionally. Remove from heat, stir in 3 teaspoons vanilla and 1/2 teaspoon baking soda, and mix well. Pour sauce over popcorn and stir until well coated. Add popcorn to prepared baking dishes and bake for 45 minutes, stirring every 15 minutes. Cool completely before serving. Store leftovers in an airtight container.

What to Look for This Week

Housing data will share headlines with the Fed, starting with builder confidence for March from the National Association of Home Builders on Monday. Tuesday brings news on February’s Housing Starts and Building Permits, while Existing Home Sales data follows on Thursday. The Fed’s meeting begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday. Investors will be closely listening for news regarding the timing of rate cuts later this year. Also of note, the latest Jobless Claims and an update on manufacturing for the Philadelphia region will be reported on Thursday.

Technical Picture

Mortgage Bonds broke beneath their 25-day Moving Average and ended last week testing the next floor of support at the 100.427 Fibonacci level. The 10-year is trading in the middle of a range with support at its 100-day Moving Average and a ceiling at 4.35%.

If you have any questions, please contact me today!