Week of June 3, 2024 in Review

Despite stronger than expected job growth in May, there are some signs that the labor market is softening. Plus, appreciating home values show the opportunity that remains in homeownership. Here are last week’s highlights:

- Big Discrepancy in Jobs Data

- Private Payrolls Show Signs of Weakness

- Job Openings Continue to Contract

- Initial Jobless Claims Hit 4-Week High

- Opportunity in Housing Remains Strong

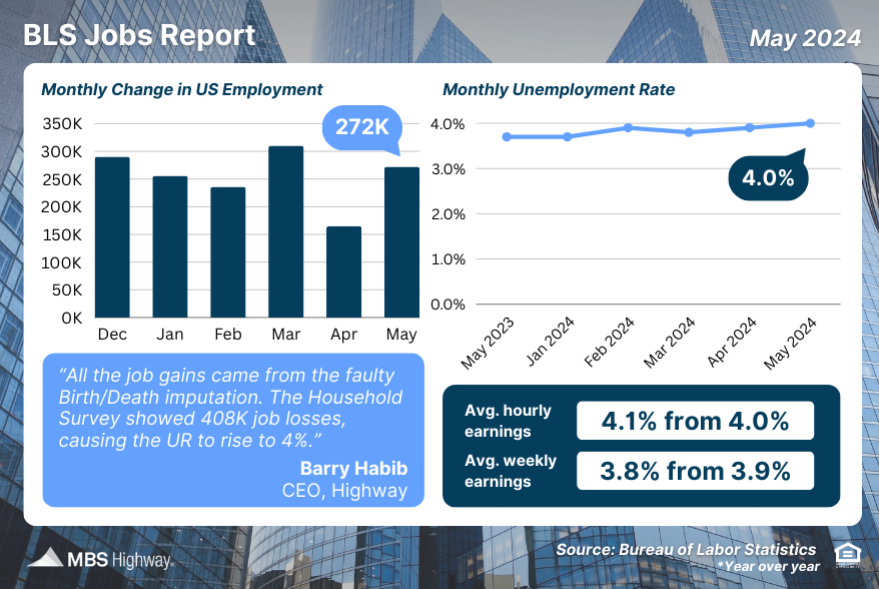

Big Discrepancy in Jobs Data

The Bureau of Labor Statistics (BLS) reported that there were 272,000 jobs created in May, which was much stronger than the 185,000 new jobs that had been forecasted. However, negative revisions to March and April cut 15,000 jobs in those months combined while the unemployment rate rose from 3.9% to 4%, which is the highest since January 2022.

What’s the bottom line? It’s important to look at both surveys within the Jobs Report, which told two different stories regarding job growth. The headline job number comes from the report’s Business Survey, which is based predominantly on modeling and estimations. In fact, one of the biggest reasons we saw large job gains last month was the birth/death model, where the BLS estimates new business creation relative to closed businesses and how many jobs this created.

In May, this modeling added 231,000 jobs to the headline figure, which would have shown a gain of just 41,000 jobs otherwise. Meanwhile, the Household Survey’s job creation component (which is considered more real-time because it’s derived by calling households) showed 408,000 job losses – a huge divergence from the headline figure! Looking more closely at this data, part-time workers increased by 286,000 while full-time workers fell by 625,000, suggesting some softening in the job market despite the strong headline number.

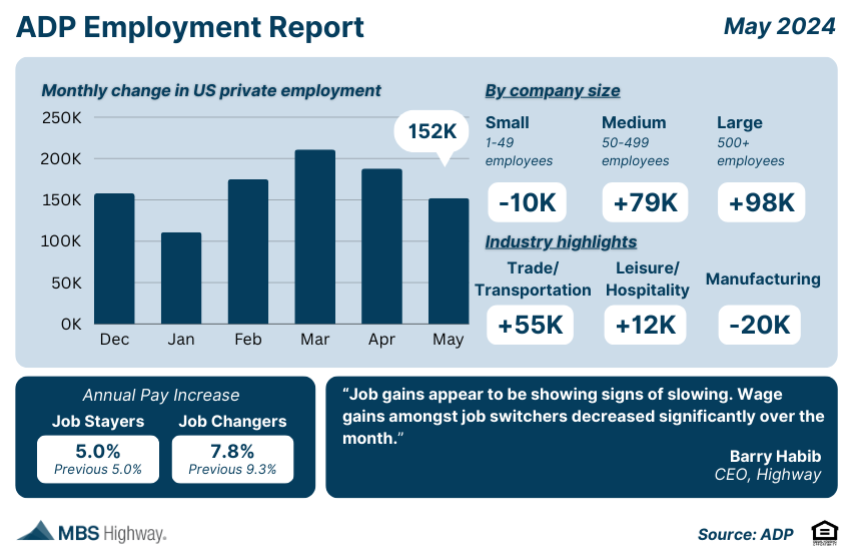

Private Payrolls Show Signs of Weakness

ADP’s Employment Report showed that private payrolls rose less than expected in May, as employers added 152,000 new jobs versus the 175,000 that had been forecasted. Job growth in April was also revised lower by 4,000 jobs. Nearly all the gains came from service-providing sectors (+149,000), with goods producers only adding 3,000 jobs due to a slowdown in manufacturing and mining.

Small businesses also continue to feel the pinch, as those with fewer than 50 employees reported 10,000 job losses. This is compared to 177,000 new jobs added among medium and large companies combined.

Annual pay gains decelerated for job changers, with ADP reporting an average increase of 7.8% in May versus 9.3% in April. Job stayers saw an average increase of 5% for the third month in a row.

What’s the bottom line? “Job gains and pay growth are slowing going into the second half of the year,” said Nela Richardson, chief economist, ADP. “The labor market is solid, but we’re monitoring notable pockets of weakness tied to both producers and consumers.”

Job Openings Continue to Contract

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings contracted to 8.059 million in April, coming in well below estimates, while March’s openings also saw a significant revision lower from 8.488 million to 8.355 million. The hiring rate and quit rate both held steady at 3.6% and 2.2%, respectively.

What’s the bottom line? Job openings have reached their lowest level since February 2021 and are now well below the high of 12 million hit in 2022. Plus, the quit rate has also fallen over the last year, suggesting there is less poaching from other companies and fewer people feel confident about finding new employment. Overall, this data is another sign that weakness is building in the labor sector.

Initial Jobless Claims Hit 4-Week High

Initial Jobless Claims rose by 8,000 in the latest week, with 229,000 people filing new unemployment claims. There were also 1.792 million people still receiving benefits after filing their initial claim, as Continuing Claims increased by 2,000.

What’s the bottom line? While Initial Jobless Claims remain low on a historical basis, Continuing Claims are still trending near some of the hottest levels we’ve seen in recent years, suggesting that layoffs remain low but the pace of hiring has slowed. This correlates with the slowdown in hiring seen in the JOLTS report, as well as the latest Job Cuts report from Challenger, Gray & Christmas, which showed that hiring announcements fell to their lowest year-to-date level in a decade.

Opportunity in Housing Remains Strong

CoreLogic’s Home Price Index showed that home prices nationwide rose 1.1% in April after rising 1.2% in March, showing that home price appreciation remains strong this spring. Prices are also 5.3% higher when compared to April of last year. CoreLogic forecasts that home prices will rise 0.8% in May and 3.4% in the year going forward, though their forecasts are typically on the conservative side so it’s possible appreciation will be even higher.

ICE (formally known as Black Knight) also reported that national home values rose 0.3% in April after seasonal adjustment, with their index showing that prices are 5.1% higher than a year ago.

What’s the bottom line? The latest rise in home prices reported by CoreLogic and ICE echoes the strong growth seen by other major indices like Case-Shiller and the Federal Housing Finance Agency. These reports continue to demonstrate why homeownership remains a good opportunity for building wealth through real estate.

Family Hack of the Week

Celebrate National Cupcake Lovers Day on June 13 with these rich and decadent Chocolate Ganache Cupcakes courtesy of the Food Network. Yields 12 cupcakes.

- Preheat oven to 325 degrees Fahrenheit.

- Line a muffin pan with paper liners.

- Cream 1/4 pound unsalted butter (room temperature) and 1 cup sugar in the bowl of an electric mixer with the paddle attachment until light and fluffy.

- Add 4 extra large eggs (room temperature), 1 at a time.

- Mix in 1 1/3 cup chocolate syrup and 1 tablespoon vanilla extract.

- Add 1 cup all-purpose flour and 1 teaspoon instant coffee granules and mix until just combined. Do not overmix.

- Scoop batter into prepared tin and bake for 30 minutes or until just set in the middle.

- Cool thoroughly in the muffin pan.

- To make the ganache,

- Cook 1/2 cup heavy cream,

- 8 ounces semisweet chocolate chips and

- 1/2 teaspoon instant coffee granules in the top of a double boiler over simmering water until smooth and warm.

- Dip the tops of the cupcakes into the ganache.

- Do not refrigerate.

That to Look for This Week

The Fed’s two-day meeting begins Tuesday, with their Monetary Policy Statement and press conference coming Wednesday afternoon. Members will most certainly dissect the inflation data that will be reported Wednesday morning when May’s Consumer Price Index is released. An update on wholesale inflation via the Producer Price Index follows on Thursday.

Also of note, look for news on small business optimism from the NFIB on Tuesday and the latest Jobless Claims on Thursday. Investors will also be closely watching Tuesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.

Technical Picture

After Friday’s strong headline job figure, Mortgage Bonds broke back beneath their 100-day Moving Average and the 100.427 Fibonacci level, ending last week sitting on their 25-day Moving Average. The 10- year broke above three ceilings of resistance to end last week just under its 25-day Moving Average.

If you have any questions, please contact me today.