Week of June 24, 2024 in Review

Both inflation and home sales moved lower. Meanwhile, home prices hit another all-time high. Read on for these stories and more:

- Inflation Cools in May

- New Home Sales Slip

- Pending Home Sales Continue Lower

- Home Price Gains Remain Strong

- First Quarter Only Slightly Higher Than Initially Reported

- Initial Jobless Claims Decline but Still Remain Elevated

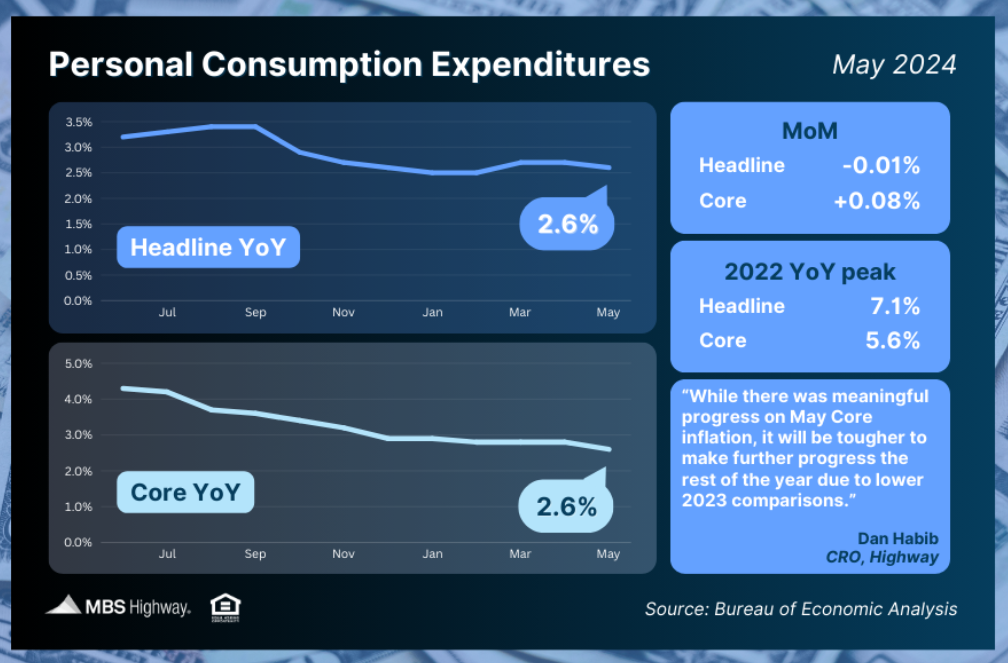

Inflation Cools in May

While May’s Personal Consumption Expenditures (PCE) showed that headline inflation was unchanged from April, the year-over-year reading declined from 2.7% to 2.6%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by less than 0.1% monthly. The year-over-year reading declined from 2.8% to 2.6%, an encouraging drop for the Fed’s mandate of stable prices.

What’s the bottom line? The Fed has been working hard to tame inflation, hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) eleven times between March 2022 and July 2023. These hikes were designed to slow the economy by making borrowing more expensive and lowering the demand for goods, so pricing pressure and inflation would shrink.

The Fed has held rates steady since last September because inflation had been making good progress lower late last year before stalling in the first quarter of this year. While Fed members have emphasized that they do not expect to cut rates until they’re confident that inflation is moving sustainably towards their 2% target (as measured by annual Core PCE), May’s tamer inflation readings are a welcome sign.

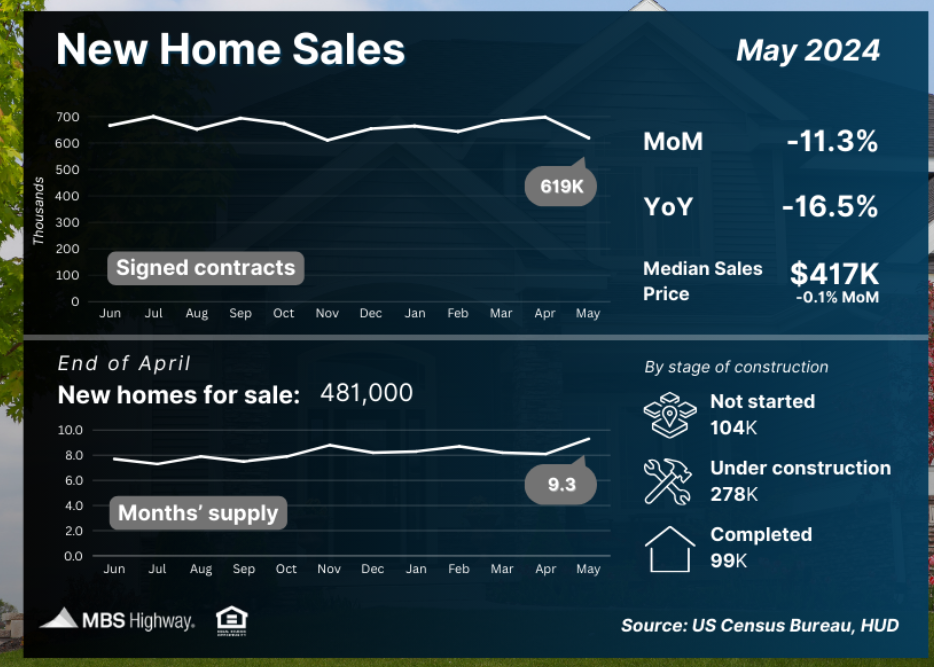

New Home Sales Slip

New Home Sales, which measure signed contracts on new homes, fell 11.3% from April to May, significantly missing forecasts that were expecting a rise. Signed contracts were also 16.5% lower than they were in May of last year.

What’s the bottom line? Despite the pullback in sales, demand for new construction remains strong due to the persistent shortage of existing homes for sale. On that note, more “available” supply is needed to meet buyer demand. While there were 481,000 new homes available for sale at the end of May, slightly higher than the 474,000 seen in the previous report, only 99,000 were completed, with the rest either under construction or not even started yet.

Also, the median home price fell only 0.1% from April but this was not due to falling home prices, which continue to rise nationwide per Case-Shiller and other appreciation indexes as noted below. The median home price represents the mid-price of sales, meaning it’s influenced by the mix of sales in any given month. Builders are constructing smaller, more affordable homes to meet buyer demand, and that pushed the median home price slightly lower comparatively.

Pending Home Sales Continue Lower

Pending Home Sales fell 2.1% from April to May per the National Association of REALTORS (NAR), coming in well below estimates of a 2.5% rise, following a 7.5% decline seen from March to April. Sales were also 6.6% lower than they were a year earlier. This report measures signed contracts on existing homes, making it an important forward-looking indicator for closings on these homes as measured in the Existing Home Sales report.

What’s the bottom line? The Pending Home Sales index took another turn lower in April after a significant drop in March, with NAR’s Chief Economist, Lawrence Yun, explaining, “the first half of the year did not meet expectations regarding home sales but exceeded expectations related to home prices. In the second half of 2024, look for moderately lower mortgage rates, higher home sales and stabilizing home prices.”

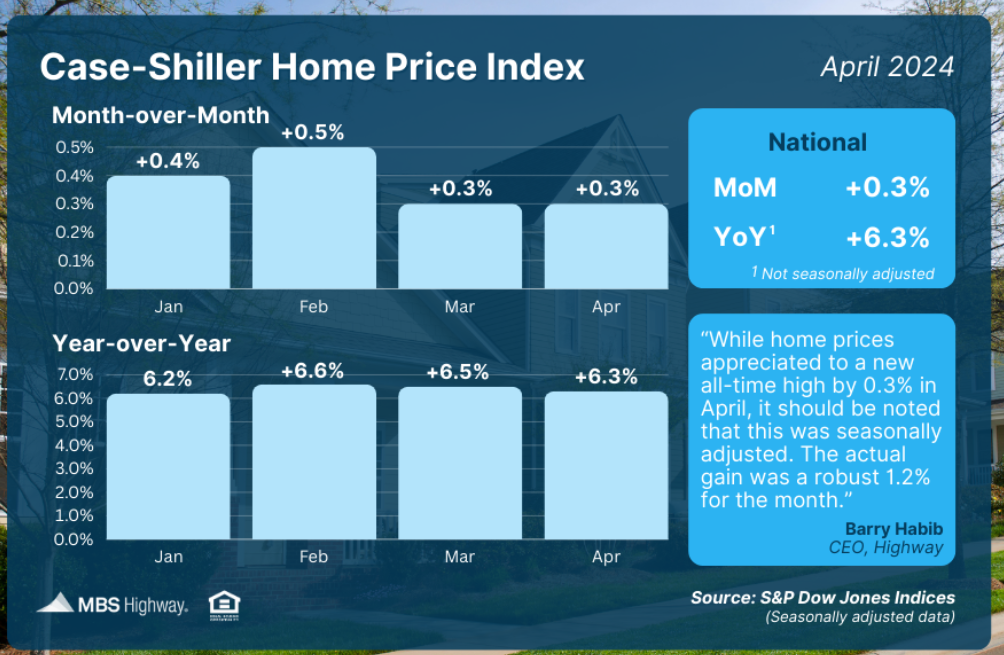

Home Price Gains Remain Strong

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.3% from March to April after seasonal adjustment. Home values in April were also 6.3% higher than a year earlier, following a 6.5% gain in March.

The Federal Housing Finance Agency’s (FHFA) House Price Index also reported a 0.2% jump in home prices from March to April, with prices 6.3% higher than the previous year. Note that FHFA does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? “For the second consecutive month, we’ve seen our National Index jump at least 1% over its previous all-time high,” confirmed S&P DJI’s Head of Commodities, Brian D. Luke. These indexes show that homeownership remains a fantastic opportunity for families to create wealth through appreciation gains.

First Quarter Only Slightly Higher Than Initially Reported

The U.S. economy grew more slowly than previously thought during the first quarter, per the Bureau of Economic Analysis, as their final reading of Gross Domestic Product (GDP) for that period showed 1.4% growth. While this was above the 1.3% pace in the second estimate, it is ultimately lower than the 1.6% pace in the first estimate. This is well below the 3.4% growth seen in the fourth quarter of last year.

What’s the bottom line? GDP functions as a scorecard for the country’s economic health, so signs of a slowdown are a concern. The deceleration in GDP in the first quarter of 2024 can be attributed to declines in consumer spending, exports, and state and local government spending.

Initial Jobless Claims Decline but Still Remain Elevated

Initial Jobless Claims fell by 6,000 in the latest week, with 233,000 people filing new unemployment claims. There were also 1.839 million people still receiving benefits after filing their initial claim, as Continuing Claims increased by 18,000.

What’s the bottom line? Initial Jobless Claims followed three straight weeks of increases with a modest decline of 6,000. Continuing Claims are also still trending near some of the hottest levels we’ve seen in recent years, suggesting that the pace of hiring has slowed. The Fed will be closely watching for any rising trends in unemployment claims as they weigh monetary policy and the timing for rate cuts, given their dual mandate and price stability and maximum employment.

Family Hack of the Week

Celebrate July 4 with these refreshing Red, White and Blue Ice Pops from the Food Network. Yields 6. Place six 3-to-4-ounce ice pop molds in the freezer for 30 minutes. Combine 2 cups strawberries (hulled and roughly chopped) and 1 tablespoon each of coconut cream, and honey in a blender and puree until smooth. Pour into a liquid measuring cup and set aside. Rinse the blender. Combine 1/2 cup unsweetened coconut milk and 1 tablespoon each of coconut cream and lime juice in the blender and puree until smooth. Evenly divide the strawberry puree between the frozen pop molds. Layer the coconut milk mixture over the strawberry puree. Freeze for 30 minutes. Rinse the blender. Combine 2 cups blueberries and 1 tablespoon each of coconut cream, honey and lime juice in the blender and puree until smooth. Remove frozen pop molds from freezer and add the blueberry puree. Insert the pop mold stick and freeze until set, at least 4 hours or overnight. Let sit at room temperature for 5 minutes before unmolding and serving.

What to Look for This Week

We’ll see more appreciation data from CoreLogic on Tuesday, and then labor sector news will dominate the headlines. Look for updates on job openings Tuesday, private payrolls and unemployment claims Wednesday, and non-farm payrolls and the unemployment rate Friday. The markets will close early on Wednesday and all-day Thursday in celebration of the July 4 holiday.

Technical Picture

Mortgage Bonds have finally broken out of the range they had been trading in since June 11, but the wrong way and to the downside. Bonds broke beneath the 100.427 Fibonacci level, 25-day Moving Average, and are testing the 100-day Moving Average currently. There is additional support not far from current levels at the 50-day Moving Average should the 100-day not hold.

The 10-year has moved higher to 4.36%, but is at a very strong triple ceiling, formed by the 200-day, 100-day, and 25-day Moving Averages. Although Yields moved higher today, the damage appears to have stopped and the technical levels are holding.

If you have any questions please contact me today!