Week of July 22, 2024 in Review

The Fed’s preferred inflation measure, annual Core PCE, remained at a three-year low while home sales were subdued in June. Plus, economic growth in the second quarter surprised to the upside. Here are last week’s headlines:

-Inflation Readings Keep Fed on Track for September Rate Cut

-Existing Home Sales Decline, Inventory Ticks Higher

-New Home Sales Hit 7-Month Low

-Second Quarter GDP Stronger Than Forecasted

-Jobless Claims Improve but Remain Elevated

Inflation Readings Keep Fed on Track for September Rate Cut

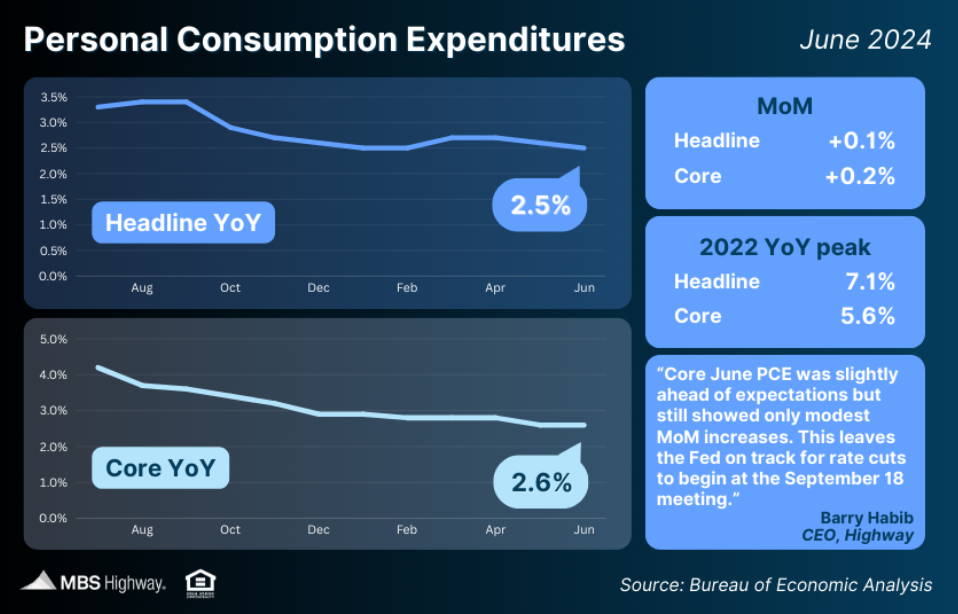

June’s Personal Consumption Expenditures (PCE) showed that headline inflation rose 0.1% from May, while the year-over-year reading declined from 2.6% to 2.5%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose 0.2% monthly. The year-over-year reading held steady at 2.6%, remaining at the lowest level in three years.

What’s the bottom line? The Fed has been working hard to tame inflation, hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) eleven times between March 2022 and July 2023. These hikes were designed to slow the economy by making borrowing more expensive and lowering the demand for goods, so pricing pressure and inflation would shrink. Inflation had been making good progress lower late last year before stalling in the first quarter of this year, causing the Fed to hold rates steady since last September. However, improving readings throughout the second quarter have led to growing expectations that the Fed will cut rates at their meeting on September 18. These latest PCE numbers leave the Fed on track to make this move.

Existing Home Sales Decline, Inventory Ticks Higher

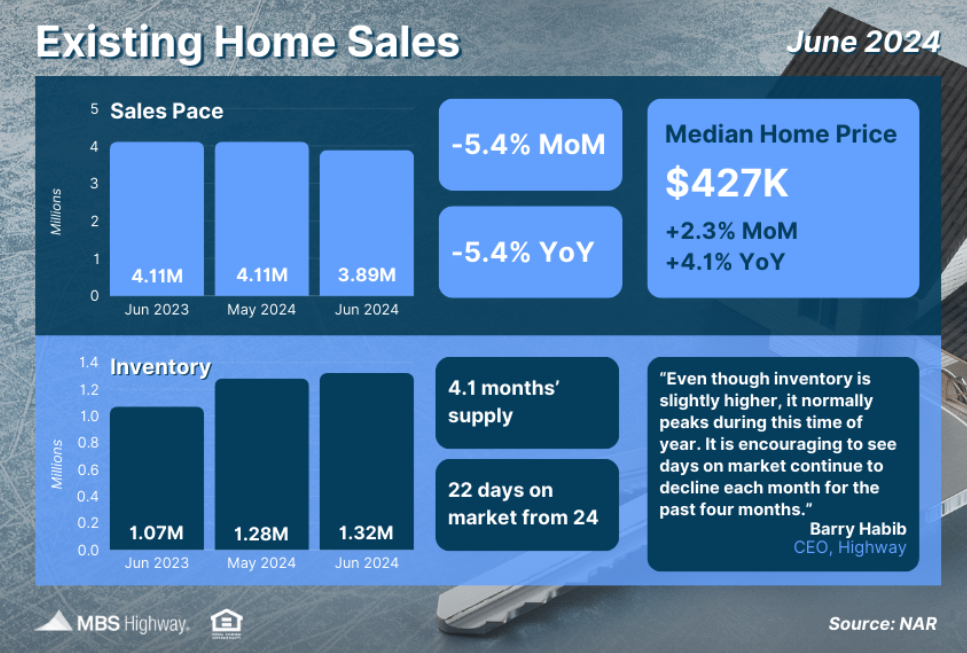

Existing Home Sales fell for the fourth straight month per the National Association of REALTORS (NAR), as June’s transactions were down 5.4% from May and also 5.4% from a year ago. This report measures closings on existing homes in June and likely reflects people shopping for homes in April and May when rates were above 7%.

What’s the bottom line? While the number of closings declined in June, some of the internals within the report point to demand remaining even in the face of elevated rates. Homes remained on the market for a shorter period than in recent months, an average of 22 days in June, down from 24 days in May, 26 days in April and 33 days in March. Plus, almost one in three homes (29%) sold above list price.

Regarding inventory, there were 1.32 million homes available for sale at the end of June, up 3.1% from May and 23.4% from a year earlier. While this remains below healthy levels, rising inventory is certainly a step in the right direction to help improve the persistent tight housing supply we’ve seen across much of the country.

New Home Sales Hit 7-Month Low

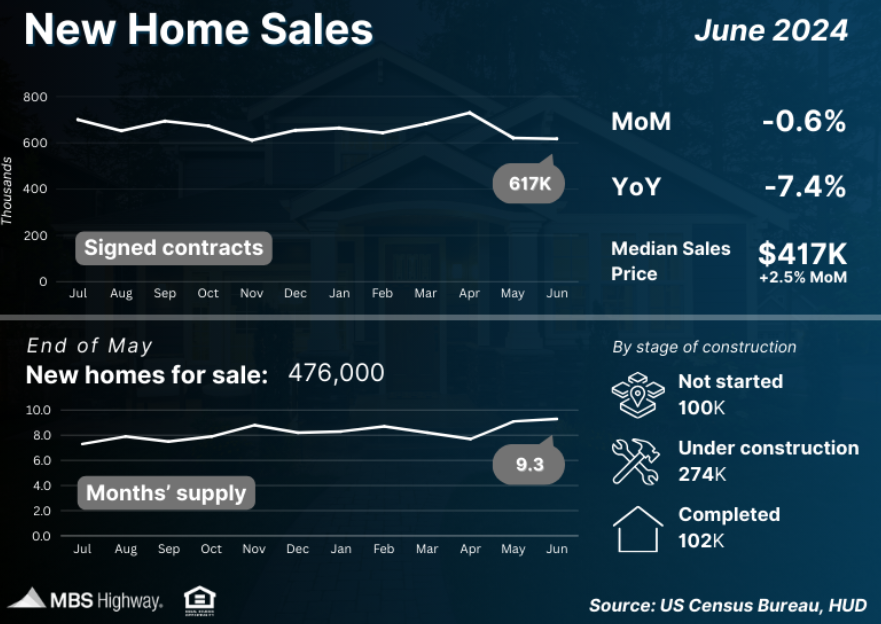

New Home Sales, which measure signed contracts on new homes, fell 0.6% from May to June, marking the second straight monthly decline and the lowest level since November. Signed contracts were also 7.4% lower than they were in June of last year, with the Northeast seeing a nearly 64% annual decline.

What’s the bottom line? Despite the pullback in sales, buyers are still turning to the new construction market, given the ongoing shortage of existing homes for sale. However, more “available” supply (i.e. completed homes ready for buyers to move into) is needed to meet buyer demand. Of the 476,000 new homes available for sale at the end of June, only 102,000 were completed, with the rest either under construction or not even started yet.

Second Quarter GDP Stronger Than Forecasted

The advance estimate of Gross Domestic Product (GDP) for the second quarter showed that the U.S. economy grew by 2.8% per the Bureau of Economic Analysis. This was well above the 2% estimate and double the 1.4% growth seen in the first quarter of this year.

What’s the bottom line? Economic activity was better than expected last quarter due in part to strong consumer spending as well as inventory build. Note that this data could be revised when the second and final readings are released on August 29 and September 26, respectively.

Jobless Claims Improve but Remain Elevated

The number of people filing for unemployment benefits fell in the latest week, though jobless claims remain elevated when compared to the beginning of this year. First-time filers as measured by Initial Claims totaled 235,000, while 1.851 million people are continuing to receive benefits after filing their initial claim.

What’s the bottom line? Both Initial and Continuing Claims have trended higher throughout June and July, with Continuing Claims topping 1.8 million for the past seven weeks. This shows that the pace of layoffs over the last two months has picked up at the same time employers have slowed down hiring.

Family Hack of the Week

August 2 is National Ice Cream Sandwich Day! Cool off with this classic recipe from The New York Times that makes for a delicious summertime treat!

- Preheat oven to 350 degrees Fahrenheit.

- Butter a 13-x-18-inch baking sheet and line it with parchment paper.

- In a medium bowl, whisk together

- 1 cup all-purpose flour,

- 3/4 cup cocoa powder,

- 3/4 teaspoon baking powder and

- 3/4 teaspoon salt.

- In a large bowl, whisk together

- 1 1/2 sticks butter and

- 1 cup sugar until creamy.

- Add 2 eggs, one at a time, and beat until smooth.

- Beat in 2 teaspoons pure vanilla extract.

- Add the flour mixture and beat until combined.

- Scrape batter into the pan and use a spatula to smooth into a thin, even layer, leaving a small border of parchment paper around the edges.

- Bake until cake is set, about 10 to 12 minutes.

- Transfer pan to a rack to cool completely.

- Transfer cake to a cutting board and cut in half so you have two 9-by-13-inch pieces.

- Scoop 1 quart of vanilla ice cream on top of one half of the cake and smooth into an even layer.

- Place the remaining piece of cake on top of the ice cream to make one large sandwich.

- Wrap well in plastic wrap and freeze until firm, about 8 hours.

- Remove from freezer, take off plastic wrap, cut into 12 smaller sandwiches and enjoy.

What to Look for This Week

It’s a jam-packed week. In housing news, look for appreciation data for May from Case-Shiller and the Federal Housing Finance Agency on Tuesday. June’s Pending Home Sales will be reported on Wednesday. Labor sector data will also make headlines, with updates on job openings Tuesday, private payrolls Wednesday, unemployment claims Thursday, and nonfarm payrolls and the unemployment rate Friday. Plus, the Fed’s two-day meeting begins Tuesday, with their Monetary Policy Statement and press conference coming Wednesday afternoon.

Technical Picture

Mortgage Bonds finally broke above resistance at 100.91 on Friday and are trading in a new range with 100.91 now acting as a floor and a ceiling at 101.20. The 10-year bounced lower off the 4.25% ceiling on Friday, with room to improve until reaching the floor at 4.17%.

If you have any questions, please contact me today!