Week of September 23, 2024 in Review

Consumer inflation continues to moderate while home prices hit another record high. Plus, housing market activity is slowly increasing on the heels of lower mortgage rates. Read on for these stories and more:

- Consumer Inflation Trending in Right Direction

- August New Home Sales Beat Estimates

- Pending Home Sales Tick Higher

- Another Record High for Home Prices

- U.S. Economy Grew by 3% in Second Quarter

- Continuing Jobless Claims Suggest Slower Pace of Hiring

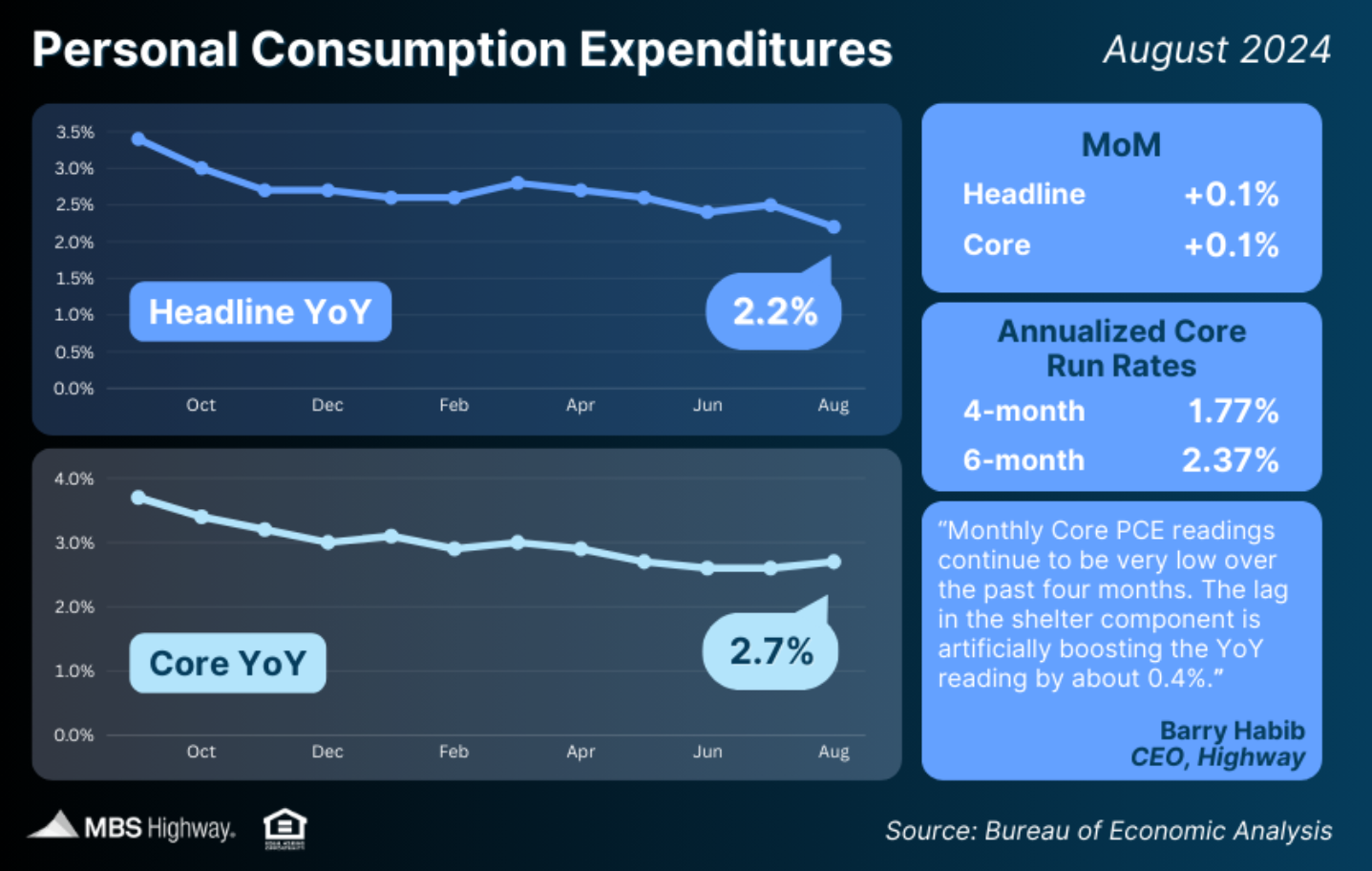

Consumer Inflation Trending in Right Direction

August’s Personal Consumption Expenditures (PCE) showed that headline inflation rose 0.1% from July, while the year-over-year reading fell from 2.5% to 2.2%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, also rose 0.1% monthly. The year-over-year reading ticked higher from

2.6% to 2.7%, remaining near the lowest level in three years.

What’s the bottom line? The trend of monthly Core PCE readings have been favorable and in line with what the Fed wants to see. In fact, if we annualize the last four months of readings, Core PCE would be 1.77%, which is below the Fed’s 2% target. Plus, shelter costs remain the largest contributor to inflation, and they’re still overstated due to the lag effect. Inflation would be even lower if more real-time shelter costs were better reflected in the reporting.

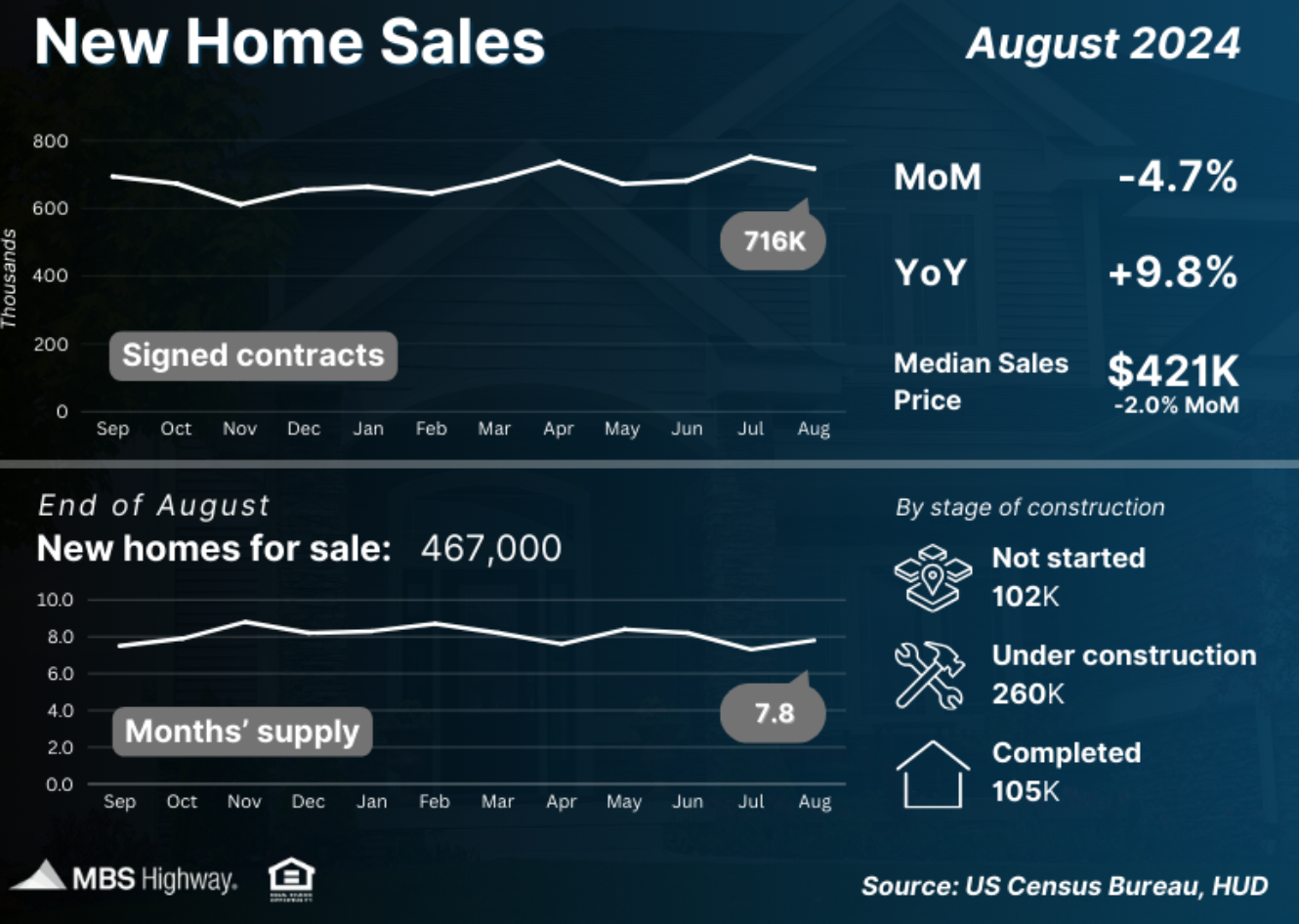

August New Home Sales Beat Estimates

New Home Sales, which measures signed contracts on new homes, declined 4.7% from July to August, though the 716K-unit pace was above forecasts and is the third highest level of the year. Plus, sales in July were revised higher to a 751K-unit pace, which is the highest level of 2024 thus far.

What’s the bottom line? The decline in mortgage rates this summer has clearly led to an increase in activity among buyers. However, more “available” supply (i.e. completed homes ready for buyers to move into) is needed to meet buyer demand. Of the 467,000 new homes available for sale at the end of August, only

105,000 were completed, with the rest either under construction or not even started yet.

Also, the median home price of $420,600 marked a 2.9% drop from July, but this was not due to falling home prices, which continue to rise nationwide as noted below. The median home price represents the mid-price of sales, and since we saw a larger mix of lower-end homes sell in August, the median home price fell slightly comparatively.

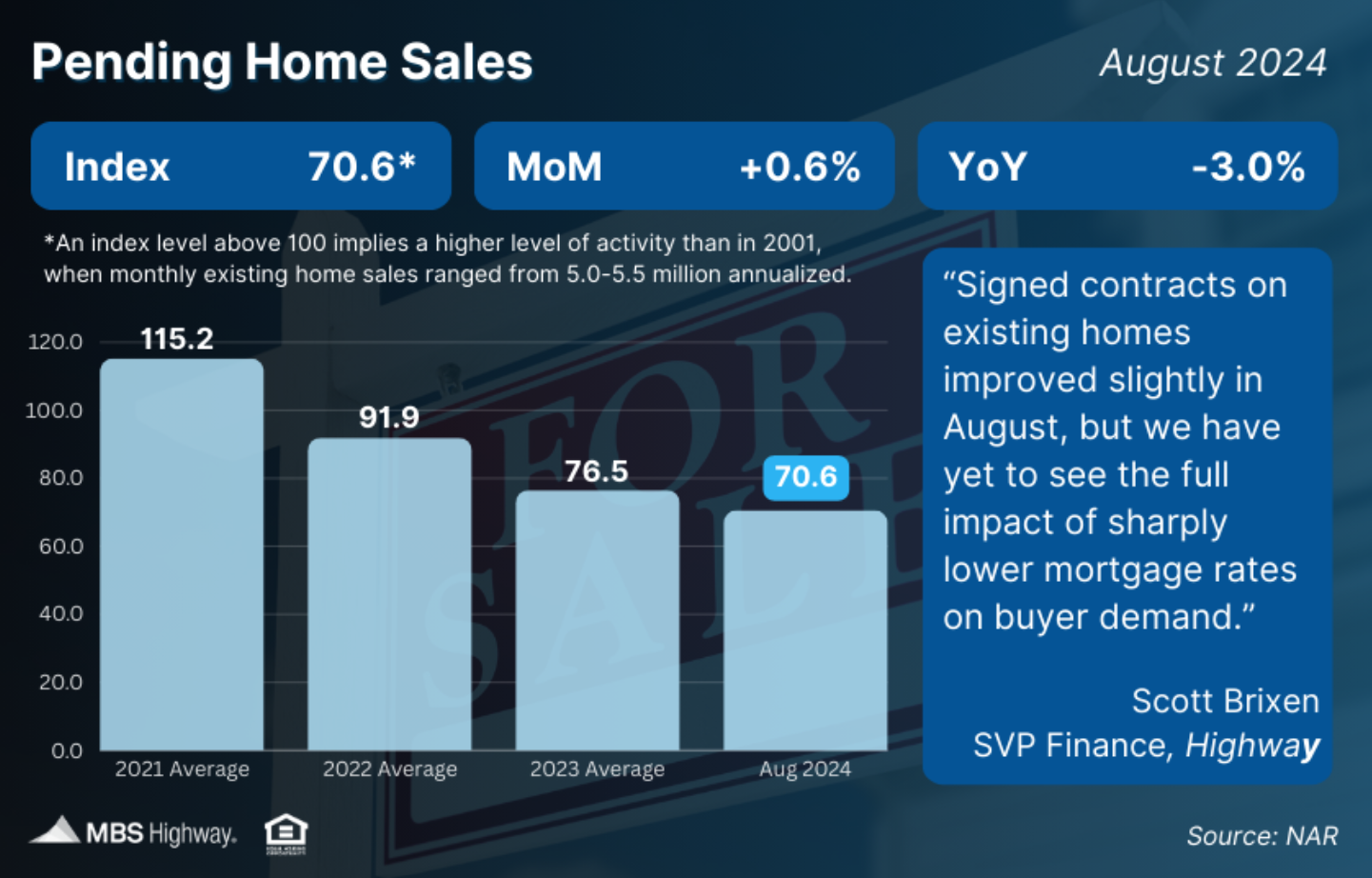

Pending Home Sales Tick Higher

Pending Home Sales, which are signed contracts on existing homes, rose 0.6% from July to August, per the National Association of REALTORS (NAR), rebounding from their lowest level this year. However, sales remain 3% lower than they were a year earlier.

What’s the bottom line? Signed contracts on existing homes are starting to pick up, but we have not yet seen the full impact of lower rates on contract activity, as it takes time for people to find a home, negotiate and eventually sign a contract. NAR’s Chief Economist, Lawrence Yun, added that the slight move higher in

activity “reflects a modest improvement in housing affordability.”

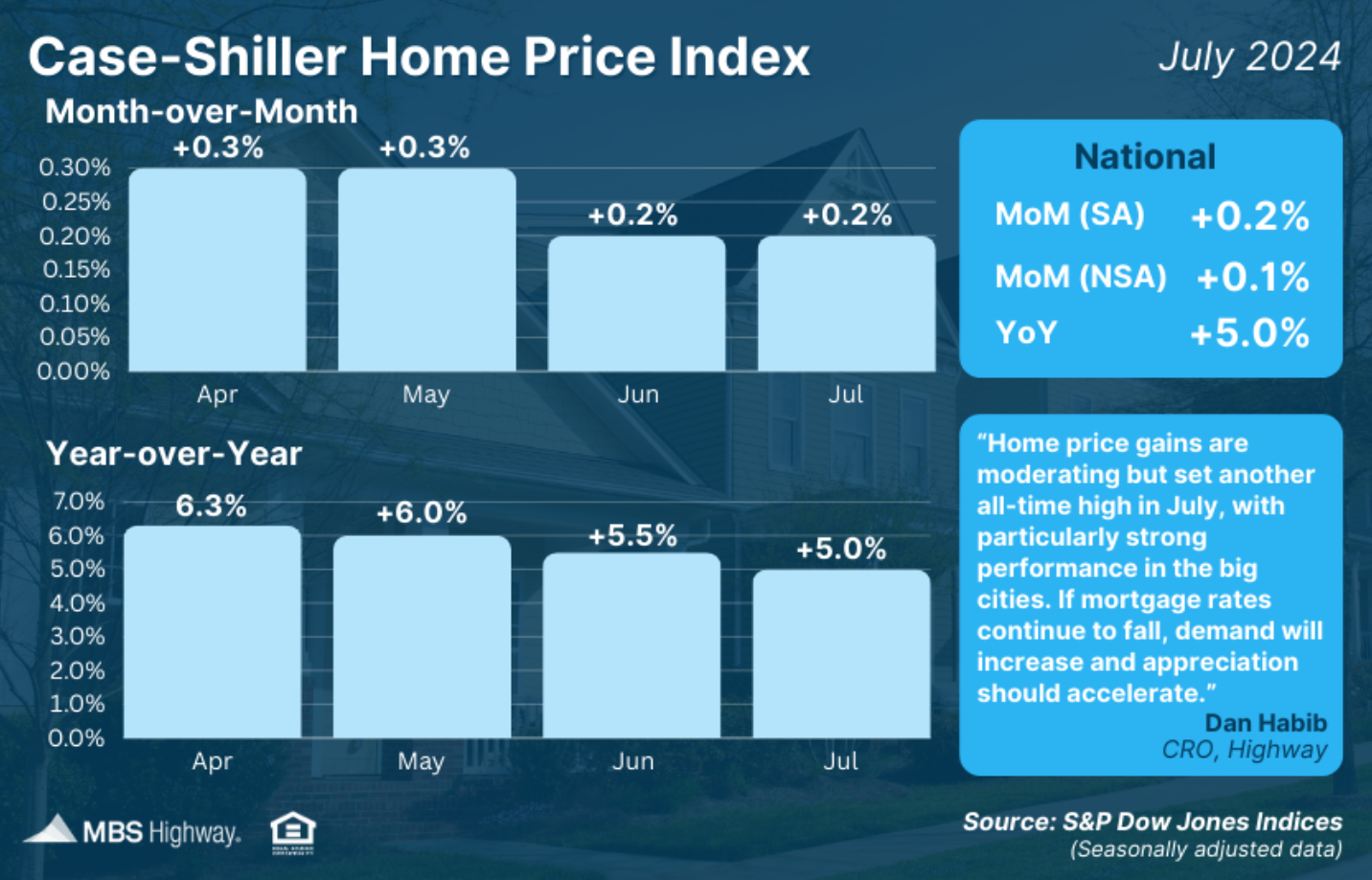

Another Record High for Home Prices

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.2% from June to July after seasonal adjustment, breaking the previous month’s all-time high. Home values in July were also 5% higher than a year earlier, following a 5.5% gain in June. Case-Shiller’s 10-city (+6.8% YoY) and 20-city (+5.9% YoY) indices showed even higher growth than the nationwide figures, showing that big cities are outperforming the rest of the nation. In addition, lower-priced homes appreciated at a faster rate than the overall market, which makes sense as there is greater demand at the lower end of the market.

The Federal Housing Finance Agency’s (FHFA) House Price Index also showed that home prices rose 0.1% from June to July, and they were 4.5% higher when compared to the same time last year. Note that FHFA’s data does not include cash buyers or jumbo loans, only loans financed with conforming mortgages. These

factors account for some of the differences in the two reports.

What’s the bottom line? S&P DJI’s Head of Commodities, Brian D. Luke, explained, “Accounting for seasonality of home purchases, we have witnessed 14 consecutive record highs in our National Index.” Despite the negative media, national home prices continue to move higher and provide a significant wealth

creation opportunity.

U.S. Economy Grew by 3% in Second Quarter

The final reading on second quarter GDP showed that the U.S. economy grew by 3%, per the Bureau of Economic Analysis. This was in line with estimates and much stronger than the pace seen in the first quarter, which was revised higher from 1.4% to 1.6%.

What’s the bottom line? Economic activity was better than expected in the second quarter due in part to increases in consumer spending, private inventory investment and business investment. As of now, expectations are that economic growth in the third quarter of this year will remain around 3% as well.

Continuing Jobless Claims Suggest Slower Pace of Hiring

Initial Jobless Claims fell by 4,000 in the latest week, with 218,000 people filing for unemployment benefits for the first time. Continuing Claims rose by 13,000, as 1.834 million people are still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims remain tame, showing that employers are reluctant to let their employees ago. At the same time, Continuing Claims have now topped 1.8 million for 16 straight weeks, remaining near highs from November 2021, suggesting that employers have also slowed down their pace of hiring.

Family Hack of the Week

October 1 is National Pumpkin Spice Day, making the perfect reason to enjoy these Perfect Pumpkin Muffins courtesy of Allrecipes. Yields 14 muffins.

- Preheat oven to 350 degrees Fahrenheit.

- Grease 14 muffin cups.

- In a large bowl, mix 1 15-ounce can pumpkin puree, 3/4 cup melted butter, 3/4 cup brown sugar, 1/4 cup water, 2 large eggs and 1 teaspoon vanilla.

- In a separate bowl, mix 1 3/4 cups all-purpose flour, 1/2 cup granulated sugar, 2 teaspoons pumpkin pie spice, 1 teaspoon salt, 1 teaspoon baking soda, 1 teaspoon cinnamon, and 1/4 teaspoon baking powder.

- Pour flour mixture into pumpkin mixture and mix until fully incorporated.

- Spoon batter into prepared muffin cups, filling each 3/4 full.

- Bake until muffins are slightly browned on top and spring back easily when pressed, around 25 to 30 minutes.

What to Look for This Week

The labor sector will take center stage, with updates on job openings Tuesday, private payrolls Wednesday, unemployment claims Thursday, and nonfarm payrolls and the unemployment rate Friday.

Technical Picture

Friday’s cooler inflation data helped Mortgage Bonds climb back above their 25-day Moving Average. They now have room to move higher until reaching the ceiling at 101.52. The 10-year also improved Friday and ended last week re-testing support at its 25-day Moving Average. If yields can get back beneath this level,

the next stop is another visit at 3.663%.

If you have any questions, please contact me today!